|

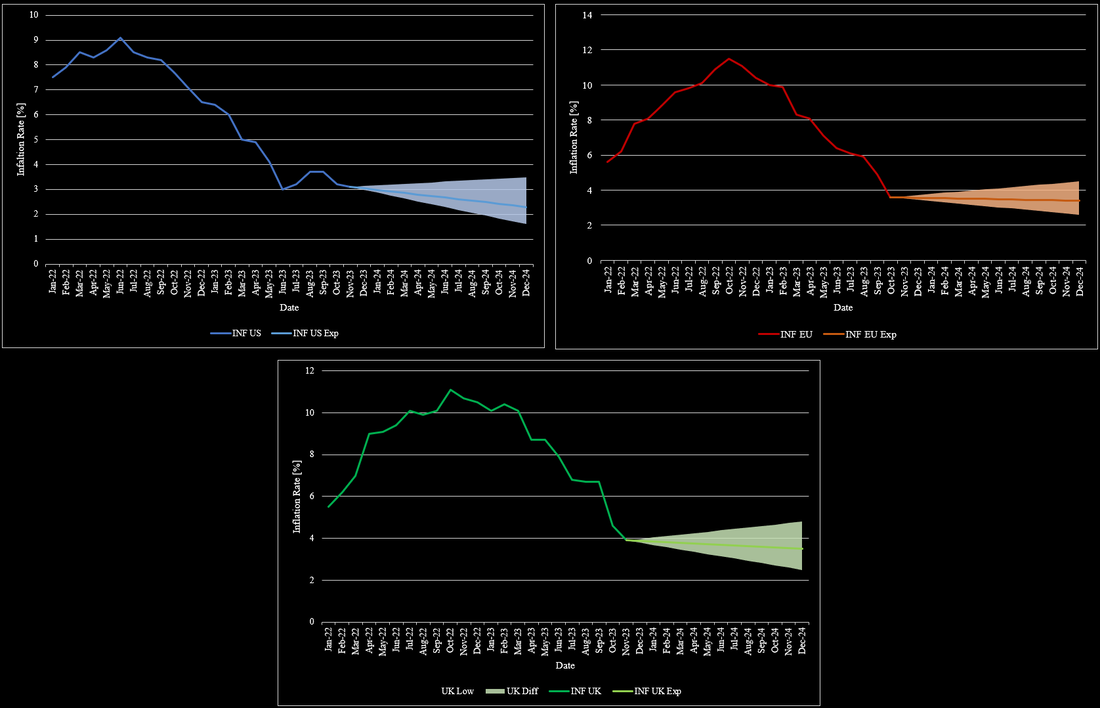

Inflation and interest rates have been present topics. Inflation rates have continuously decreased throughout 2023 across most economies. While this development was promising, it was necessary as inflation rates went as high as almost 12% towards the end of 2022. In the US, inflation has decreased to 3%-4% in the past few months with no particular direction since then. For 2024, it is widely expected that inflation will decrease further, albeit to a limited degree. Most market participants expect inflation to be around 2.3% by the end of 2024. Others see inflation to drop to as low as 1.6%. Assuming no further geopolitical crises and no further escalation of existing crises, inflation is unlikely to rise further than 3.5% by the end of 2024. Figure 1 shows the development of inflation rates in the US, UK, and the EU from January 2022 to the end of 2024. The general sentiment that inflation rates should fall is intuitive given the high interest rates at this time. In the EU, the development has mostly mimicked the US, but with a delay of a couple of months, due to a more restrictive central bank policy when Covid-19 emerged. Inflation in the EU has also reached a point, where inflation is no longer declining at levels slightly below 4% after being at 10% at the beginning of the year. For 2024, inflation is also expected to further fall, but not to the same degree as in the US. Expectations for inflation in the EU range from 2.6% to 4.5% with the most likely level around 3.4%. The situation in the UK also drastically improved towards the end of the year. UK’s inflation fell to 4% after lingering around the 10% mark for almost an entire year. Inflation expectations for the UK are mostly equivalent to the EU’s expectations, but its projections are more volatile based on the country’s state over the past few years.

The month of November has been quite successful for equities and bonds alike. With the stabilizing macroeconomic landscape, markets have adjusted to the current state with high rates and moderate to high, but decreasing, inflation. In the past month, there were promising signs that no more hikes are necessary to combat inflation. A notable percentage of market participants is even optimistic about rate cuts soon. While US inflation has gone down substantially already in summer, European countries are following and are on their way to similar levels as the US. Unsurprisingly, this led to a more positive view on longer-term rates. This was evident in falling yields for longer-term bonds. US and UK 10-year bonds’ yield decreased by around 10% since October, while German 10-year bonds decreased by almost 25%. Figure 1 summarizes the development of 10-year yields from October in the previously mentioned countries.

The conflict between Israel and the Hamas is in full force and it seems unlikely that the situation will be resolved soon. While the conflict started with an attack from Hamas on civilians in Israel, the focus has fully shifted towards Gaza with group, air, and sea retaliation by the Israel military. Israel is strongly focusing on Gaza, as it is seen as the center of the Hamas. The conflict in Gaza is widely seen as a precarious situation, as Israel is completely blocking entry or exit even for vital goods, such as food, water, and medical supplies. While Israel was supported initially by most Western countries (especially due to the many hostages taken), support is continuing to fade, due to the humanitarian crisis it caused in Gaza. Despite the decreasing support, Israel seems determined to not only free all hostages, but also disabling the military and governmental capabilities of the Hamas. Unsurprisingly, the conflict also affected financial markets significantly. While initial price shocks mostly normalized since early October 2023, oil markets could experience further volatility. Additionally, given the already pressured economies, investors move more capital into safe-haven assets, in particular US-Dollar and gold.

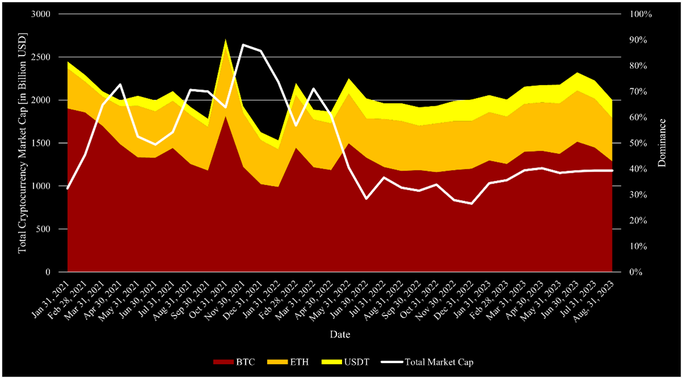

The cryptocurrency markets have been relatively quiet this year. Aside from the surge at the beginning of the year, cryptocurrencies have remained relatively flat since then. The total market capitalization of the industry started slightly below $1tn at the beginning of 2023 and has remained at around $1.2tn since March 2023. The relatively low volatility of the industry also signals a certain level of cautiousness of investors, as the market environment is not great for the industry. In particular recession concerns are holding the industry back, as cryptocurrencies are notorious for sharp declines. Options data on cryptocurrencies also supports a more defensive notion of investors, as implied volatility is close to a record low. The lower degree of risk appetite is also visible in the Bitcoin (BTC) and Ethereum (ETH) dominance. This measure quantifies the total market capital of BTC and ETH respective to the total cryptocurrency market capitalization. Their dominance has been on the rise since Q3 2022 and shows fewer investments in riskier and emerging projects. Similarly, during these times stablecoin gained more importance in the space due to their stability compared to other coins. Figure 1 shows the total market capitalization of cryptocurrencies and the dominance of BTC, ETH, and USDT. Historically, these times are the most important ones for the space, as it drives innovation. With no frenzy, emerging companies are not in a rush to cash out which allows them more time to develop their projects.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed