ADVISORY

We provide leading alternative investment advisory to our clients in the areas:

We provide leading alternative investment advisory to our clients in the areas:

|

|

|

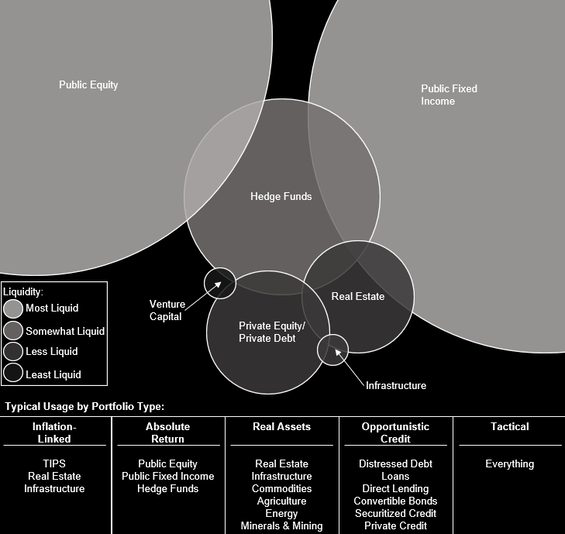

ALTERNATIVE INVESTMENT ADVISORY CROSS ASSET ADVISORY We believe that comprehensive alternative investment advisory should reach across asset classes and interface between illiquid investments like real assets, infrastructure, venture capital, private equity, private debt, real estate and more liquid investments like absolute return strategies, hedge funds and fund of funds. Our main target is to achieve an optimal asset allocation for our clients in terms of performance, risk and liquidity under consideration of investment structure, size, and track record. RISK ADVISORY Cross asset advisory implies an in-depth analysis of asset specific risk factors. Therefore, we provide the most sophisticated credit, market, operational, liquidity and integrated risk advisory. |

Stone Mountain Capital has total alternative Assets under Advisory (AuA) of US$ 62.4 billion*. US$ 48.5 billion* is mandated in hedge funds and US$ 13.9 billion* in private assets and corporate finance (private equity, venture capital, private debt, real estate, fintech). Stone Mountain Capital has arranged new capital commitments of US$ 1.95 billion* across more than 25 hedge fund, private asset and corporate finance mandates and has been awarded over 100 industry awards for research, structuring and placement of alternative investments. As a socially responsible group, Stone Mountain Capital is a signatory to the UN Principles for Responsible Investing (PRI). Stone Mountain Capital applies Socially Responsible Investment (SRI) filters to all off its alternative investment strategies and general partners on behalf of investors.

* As of 2nd February 2024

* As of 2nd February 2024

|

|

|