MANDATES

|

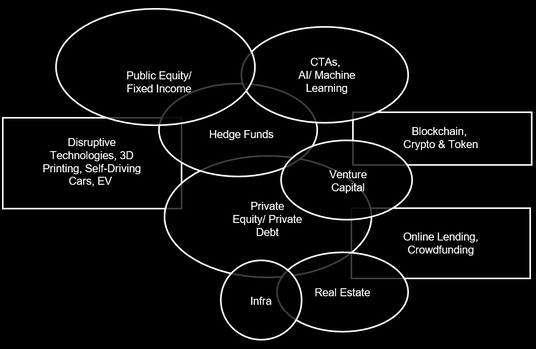

HEDGE FUNDS

We are mandated for capital introduction and as retained placement agent in more than 30 leading hedge fund managers with long standing and solid performance track records, liquidity provision, standardized commingled fund structures like Cayman master feeder / AIF / UCITS, ETI / ETN / ETF, and managed account structures (SMAs) with established assets under management (AuM) across the 4 main strategies: EQUITY

CREDIT / FIXED INCOME

TACTICAL TRADING

FUND OF HEDGE FUNDS (FOF)

|

PRIVATE ASSETS

We are mandated for financial structuring, rating advisory and as retained placement agent of more than 10 corporate finance transactions across the capital stack and in private assets for private equity / venture capital, private credit / private debt, real estate and fintech. We cover direct and co-investments in alternative vehicles and firms for the entire capital structure of senior secured, unitranche, mezzanine, equity across the 4 main asset classes and sectors: PRIVATE EQUITY / VENTURE CAPITAL

PRIVATE CREDIT / PRIVATE DEBT

REAL ESTATE

FINTECH We identify the following sectors and products where innovation and disruption of fintech overlap with alternative investment advisory:

BLOCKCHAIN

|

VENTURE CAPITAL

PUBLIC PLACEMENTS

Stone Mountain Capital has total alternative Assets under Advisory (AuA) of US$ 62.4 billion*. US$ 48.5 billion* is mandated in hedge funds and US$ 13.9 billion* in private assets and corporate finance (private equity, venture capital, private debt, real estate, fintech). Stone Mountain Capital has arranged new capital commitments of US$ 1.95 billion* across more than 25 hedge fund, private asset and corporate finance mandates and has been awarded over 100 industry awards for research, structuring and placement of alternative investments. As a socially responsible group, Stone Mountain Capital is a signatory to the UN Principles for Responsible Investing (PRI). Stone Mountain Capital applies Socially Responsible Investment (SRI) filters to all off its alternative investment strategies and general partners on behalf of investors.

* As of 2nd February 2024

* As of 2nd February 2024

For investor relations, research and monthly GP and Manager updates contact us:

|

INVESTOR RELATIONS

|

RESEARCH

|

GP & MANAGER UPDATES

|