|

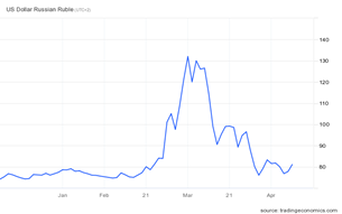

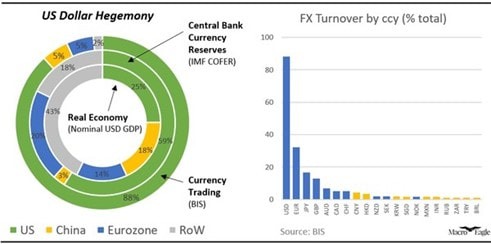

While the war in the Ukraine is going on with little progress towards peace, market participants are waiting for further moves from central banks and their announced interest rate hikes to combat inflation. Over the past months, the war had a substantial impact on the currency market, as the Russian Rubel has strongly appreciated against the US-Dollar since the invasion of Russia in the Ukraine. USD-RUB has stabilized at around 80RUB per USD, the same as it has been ahead of the crisis. This is remarkable as it spiked to more than 130 RUB/USD due to the severe sanctions imposed onto Russia. Figure 1 shows the development of RUB-USD since the start of 2022. Despite the sanctions of Russia and its currency, Russia can still control its currency well. They create artificial demand of the Rubel through different measures. For example, foreigners invested in Russia cannot sell their Rubels, they require European countries to pay Russian gas in Rubels, and they require Russian exporters to be paid to 80% of their income in Rubels. These measures all help appreciating the currency against the depreciation pressure from the sanctions. The role of the USD in the FX remains very important, as 88% of the FX transaction involve the USD as one of the currency pairs. It is also crucial in reserves for central banks as it makes up 59% in all currency reserves. This high relevance seems excessive given that it is only responsible for 25% of the world’s GDP. Nonetheless, these are consequences of a currency that is widely regarded as the world currency. An overview of this is shown in Figure 2. This is in particular relevant as for the first time sovereign currency reserves have been confiscated. This may lead central banks to diversify their reserves, increasing the relevance of other major currencies, emerging currencies and real assets, in particular gold. Gold has rallied since the initial threats were looming on the invasion of the Ukraine. It spiked at $2,052 per barrel but did not manage to hold onto this level. As the initial volatility faded, gold fell and is remaining between $1,940 and $1,980 per barrel. Figure 3 shows a summary of this development. Oil experienced substantial volatility, largely due to the invasion of Russia and Russia being a key supplier of oil. Oil started gaining since December 2021, when WTI crude was $70 per barrel. Amid geopolitical tensions and then the looming threat of the invasion, it rose to around $90 per barrel and spiked to $105 immediately once Russia effectively invaded the Ukraine. Since then, WTI rallied between $95 and $120 and has almost fallen to its lowest level since the invasion at $94 per barrel for WTI. Figure 4 summarizes this development. A similar development was observed in Brent crude, as it fell below the $100 mark for the second time only since the start of the invasion. Unlike oil, natural gas has risen to a 15-year high of $6.534 per MMBtu (metric million British terminal units), which poses a huge concern for Europe, as they are highly dependent on Russia’s gas. If Russia would decide to stop gas deliveries to European countries, this would cause a huge recession, as gas-dependent industries likely have to shut down operations very quickly. This is the case, as there are a lot more alternatives for the import of oil than there is for gas.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed