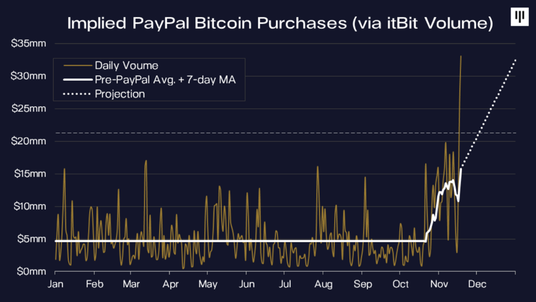

The rapidly increasing value of BTC is largely associated with the recent announcement of PayPal to accept BTC as currency, giving access to BTC to more than 300 million users, compared to only 100 million prior BTC users. According to Pantera Capital, this has had a major impact on BTC. Figure 4 below shows the increase in BTC purchases from itBit, the provider that PayPal uses for crypto transactions. Currently, Paypal and other providers are buying more than 100% of all newly issued bitcoins, creating additional demand with it. As highlighted in the figure below, the volume of transaction is shown, which remained stable during the year, but increased tremendously since PayPal enabled BTC transactions. Given the huge surge during the last two weeks, the demand is likely to increase even more, indicating that the current surge is not over yet. Moreover, if BTC surpasses its record high from 2017, it will cover the news even more, another indicator for an even higher price.

Alternative Markets Update October 2020 - Macro and Political Outlook November 2020 by Macro Eagle11/11/2020

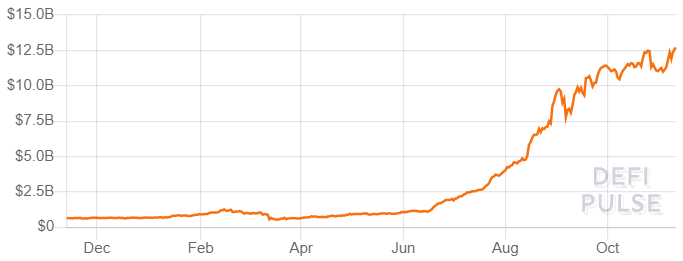

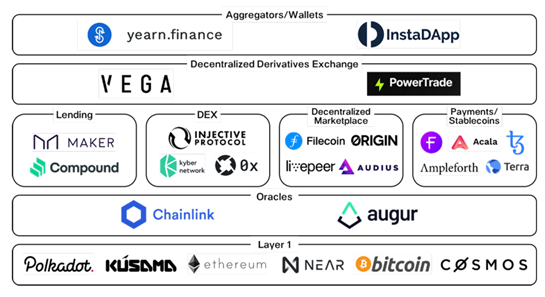

DeFi is probably the topic in the crypto space in 2020 and its steep rise during the summer. DeFi started with a total value locked in the area of millions in the year and is (as of November) at around $12.5bn. This development is also not expected to fade away towards the end of 2020, although it seems possible that there will be a decrease in growth compared to the summer. Figure 14 shows the DeFi ecosystem separated in sub-categories.

Macro and Political Outlook November 2020 by Macro Eagle

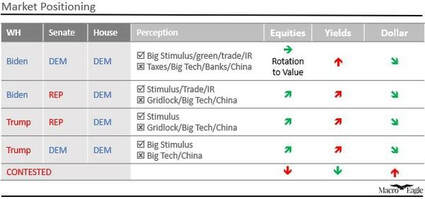

Should we get a Blue Wave, then the “consensus trades” are rotation from Growth into Value (on stimulus), overweight infrastructure/green-energy, short Treasuries (rising yields), short US Dollar and long selected Emerging Markets (like Mexico). The biggest risk in the short-term would be a sell-off due to fear of change in tax policy (wealthy Americans locking in “Stepped-Up Basis”, capital gains rate and/or Tax Loss Harvesting). The medium-term risk are higher US yields/curve steepening on the back of stimulus. For a quick overview of the other scenarios (already amply covered elsewhere) see short summary below. Also important to keep the portfolio on the right side of what won’t change, whatever the outcome: (1) More stimulus and hence higher yields; (2) China bashing; (3) Big Tech under political pressure and (4) the green-energy transition. The latter obviously turbo-charged if Biden comes in. |

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed