|

Alternative Markets Update February 2021

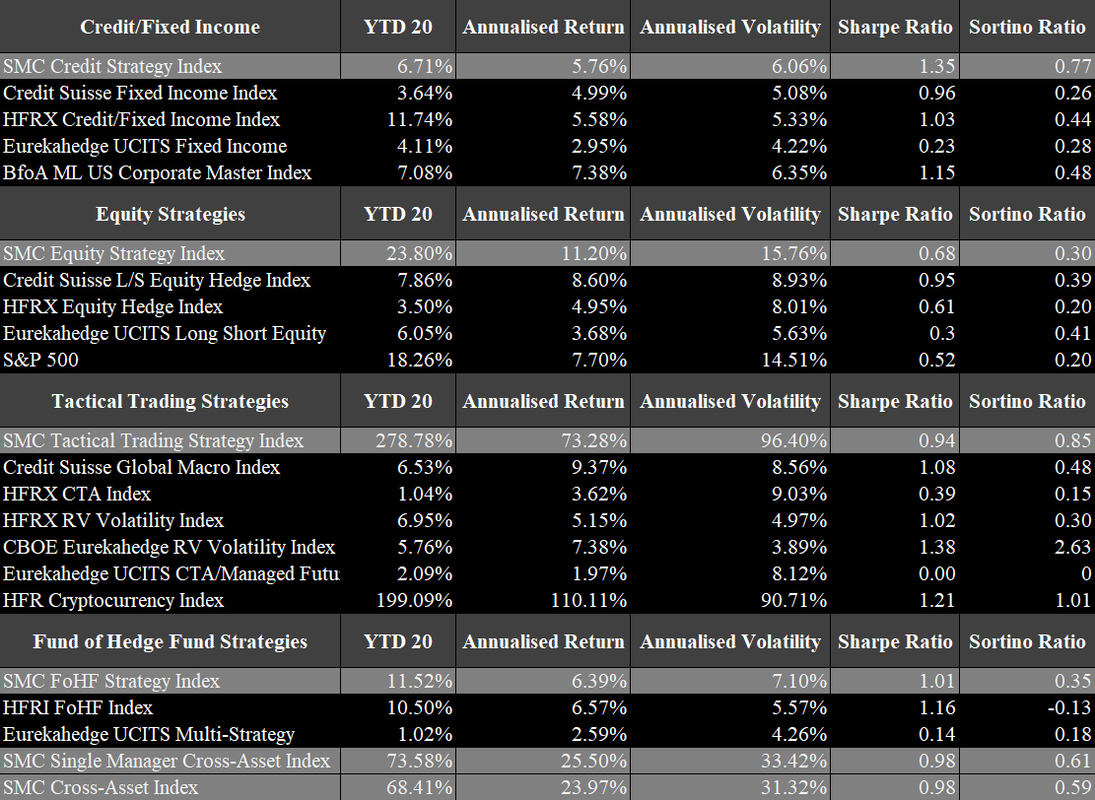

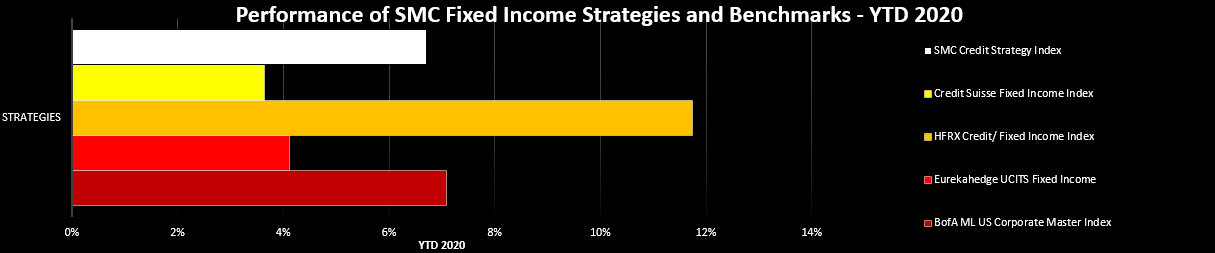

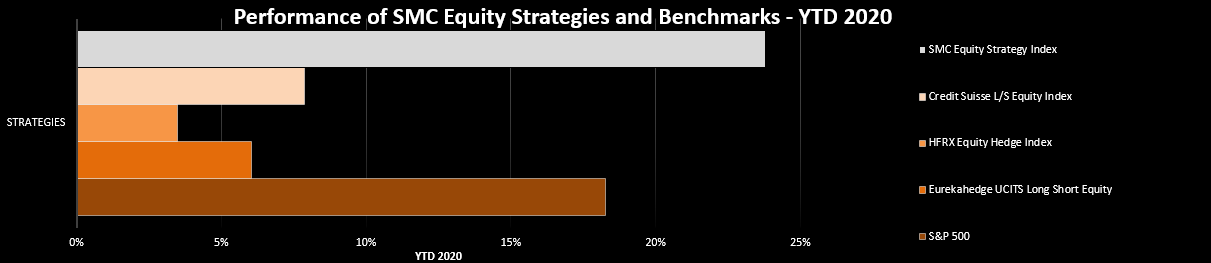

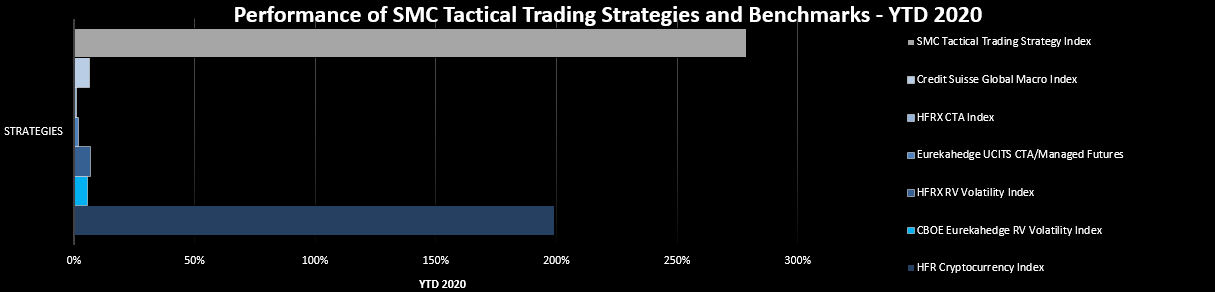

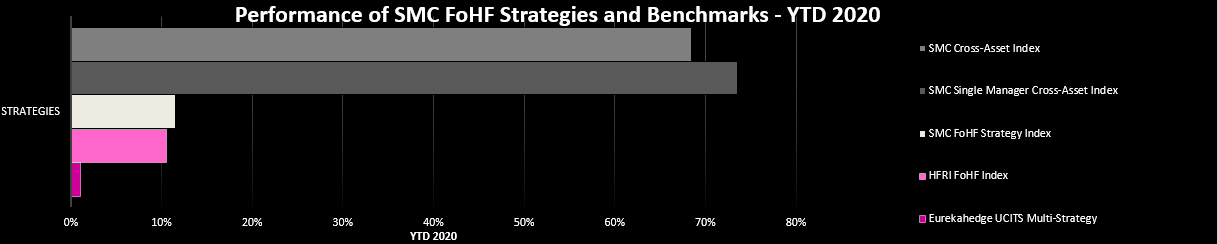

Hedge funds did not do that well in January 2021, as they could not continue their strong upward trend from the last quarter in 2020. Equity-related and fund of hedge funds strategies were down between 0% and 2%, whereas fixed income strategies ended the month slightly positive. Global macro strategies were in between the equity and credit strategies. Our most profitable strategies in January were crypto-related strategies, one of which is up almost 100% in one month only. This was driven largely by the growth in altcoins, in particular smaller ones. February 2021 is likely to affect equity strategies badly, as last week, stock markets dipped, due to profit taking in technology stocks and somewhat larger concerns about inflation. The inflation concerns are rising, as interest rates are increasing at the longer time horizon. In particular in the US and the UK a yield curve steepening is happening. This is further increased by the development in the central banks’ balance sheet, which have strongly grown. Figure 1 shows the central bank balance sheet over the last 15 years including a projection until the end 2022, which implied that the G4 central banks’ balance sheets will almost double since the start of 2020. Moreover, according to Figure 2, global debt has skyrocketed as well since 2020, as the global debt increased from around $220tn to $270tn at the end of 2020 and is expected to grow to close to $300tn at the end of 2022.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed