|

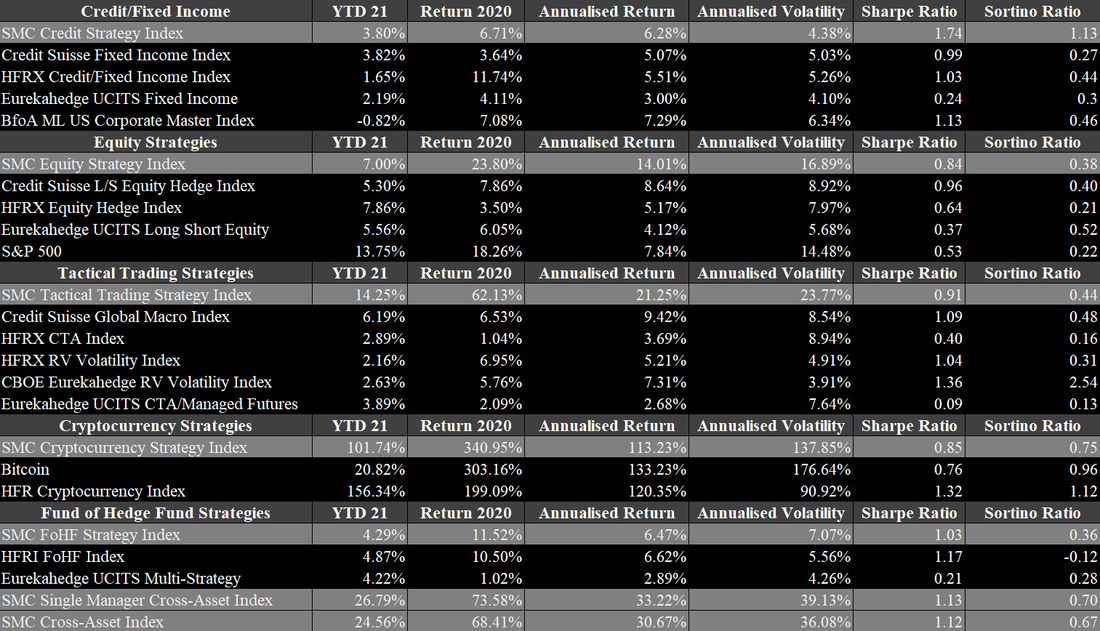

Hedge funds are doing very well currently. After having suffered substantial drawdowns in March 2020, they delivered what they promised to do. They were able to limit losses well, while profiting significantly from the subsequent upswing. This positioned hedge funds in a good light towards potential investors that previously stepped away from hedge funds or planned to, due to their frequent inability to generate excess returns in boom phases over the last few years. As the crisis was handled well by the industry, this perception significantly shifted. Preqin reported that the average return of hedge funds in 2020 was 16.69% and 12.73% as of June 2021, which are remarkable numbers for this environment. In particular, as some sectors and industries, such as fixed income, are struggling since Covid-19 emerged. Figures 9 to 14 provide a summary of our benchmark indices compared to other widely known benchmarks, based on fixed income, equity, tactical trading and fund of hedge funds strategies. Our two major benchmark indices, the SMC Single Manager Cross-Asset Index and the SMC Cross-Asset Index, are up 26.79% and 24.59% as of June 2021. Fixed Income strategies continue to struggle but managed to achieve solid one-digit returns over 2020 and 2021. The two most outstanding strategies in this asset class are European High Yield L/S Credit with a return of 13.37% in 2021 and Trade Finance Crypto with a YTD of 9.11%. The latter also has not experienced a single negative monthly return since its inception in January 2017. The performance of equity-based strategies in 2021 is 7%, while the individual strategies widely varied since 2020. On the one hand, Long/Short US Equity Consumer, TMT, Healthcare had a stellar return of 66% in 2020 but is stagnating in 2021 with a YTD of 0.13%. On the other hand, Equities US Activist Event Driven was up only 2.52% in 2020 but is up 30.68% in 2021 so far. Our SMC Tactical Trading Strategy Index is up 14% in 2021 and was up 62% in 2020. The global macro strategies deviate strongly from each other’s monthly returns. The Discretionary Global Macro strategy is up 26% in 2021, even though it suffered a loss of 18% in June 2021. In 2020, the strategy also achieved a return of 27%. The Systematic Global Macro strategy is up only 2% as of June 2021 but was up 97% in 2020. Unsurprisingly, the SMC Cryptocurrency Strategy Index had the best performance in both 2021 and 2020. In 2021, the index is up 101% and in 2020 340%. The crypto-based strategies range from Token Liquid with a YTD 2021 of 171% to Bitcoin that is up only 19.2% YTD 2021. Over the last two years, the Token strategy was the most successful one with being up 504% in 2020 and another 164% in 2021. Cryptocurrencies are further described in following section.

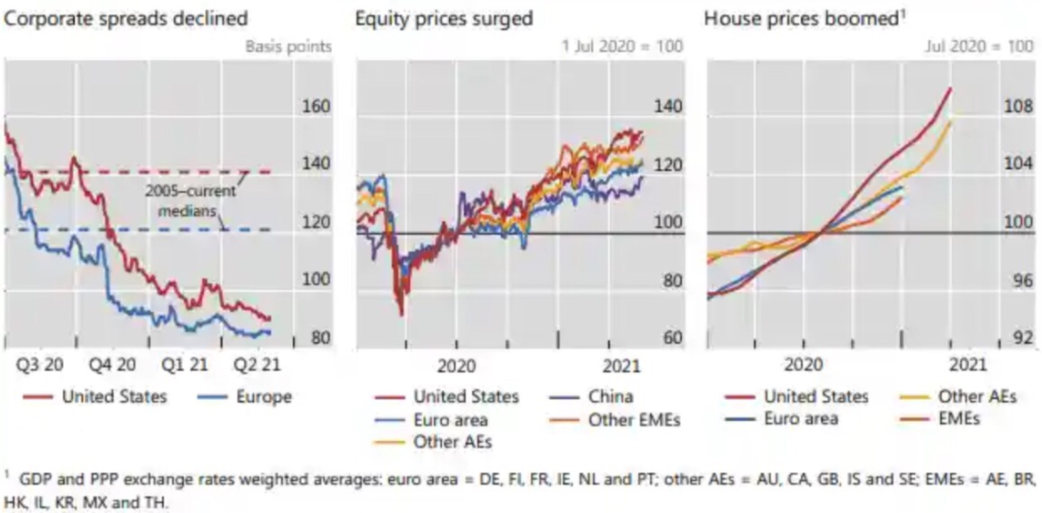

In the current market environment, alternative assets are well positioned. Due to the rise in inflation recently, the falling interest rates and equities being at record highs, it is difficult to allocate capital without huge risks. In this environment, alternative assets provide an attractive opportunity to reduce risk and increase the upside potential. During the last quarter, hedge funds and private equity have reached their record AuM. The interest in hedge funds is likely to increase further, as the industry is doing very well. Not only were drawdowns limited in March 2020, but the recovery was exceptionally strong. Furthermore, the gains in 2021 so far are the best in the last two decades and the number of launches outnumbered the numbers of closures in Q2 2021. Private equity has developed similarly over the last year. Although the beginning was difficult, the subsequent performance was great. However, operating in private equity needs a bit more caution, as a record amount of dry powder was assembled in the last year and the competition in the market fierce, which in turn, leads to higher prices and valuations. In particular in the VC space, voices of a bubble are getting louder. Housing prices have shown a very strong recovery from an initial slump after the pandemic hit, which is a consequence from the extraordinary financial conditions, largely caused by fiscal stimulus by governments and the loose monetary policy by central banks. Credit spreads have fallen to an almost record low level, despite declining profits from companies, at least initially. This suggests that market participants are aggressively seeking risk in the current financial market. Figure 1 shows a comparison of corporate spreads, equity prices and housing prices. On a relative scale, housing prices have risen more than equities since the initial Covid-19 outbreak. KKR for example has raised a $2.2bn fund for real estate deals in Europe, but real estate investments are surging as well in developing countries, such as in the UAE, in which luxury house sales are rising. There is also an increased interest in real estate tech which surged recently, certainly also boosted by the generally great performance of tech stocks.

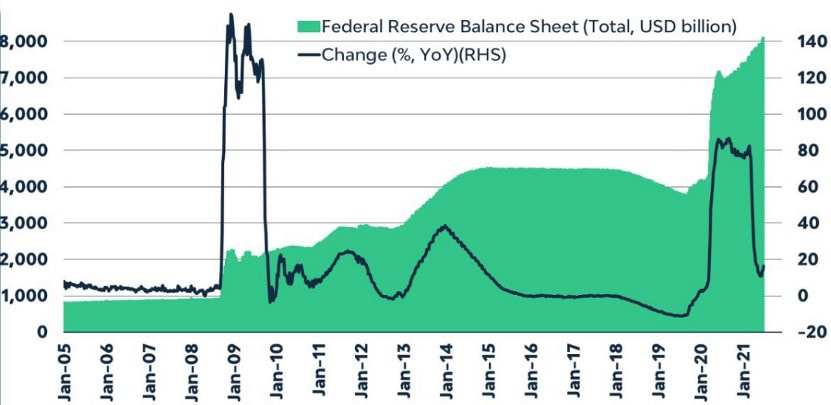

Inflation has been among the most important concerns in 2021, after the world has been able to fight the virus to some degree after over a year and a variety of vaccines. The inflation concerns stem from two main sources, the increased liquidity provided from central bank interventions through quantitative easing and the stimulus packages from governments. These two major components are shown in Figures 1 and 2. The first figure shows the balance sheet of the federal reserve. Since Covid-19, the balance sheet has doubled to $8tn. Despite the increase being smaller on a relative basis compared to the global financial crisis, the absolute terms differ vastly. While during the global financial crisis in 2008, the balance sheet grew from $1tn to $2tn, which was seen as unprecedented and extremely large intervention, it is only a quarter of the interventions following the occurrence of Covid-19 in early 2020. This has several implications. It will substantially increase the liquidity provided to the financial market and if the balance sheet is reduced, it will likely cause more volatility, as it was the case at the end of 2018 when equity markets decreased substantially. This is under the assumption that Covid-19 is now and will remain at a stage it can be handled. The entire underlying assumption could change, if, for example, a new strain of Covid-19 would emerge that is resistant to the currently available vaccinations. Figure 2 shows the government stimulus packages provided to fight the economic impact of Covid-19, which has surpassed $10tn globally. Again, this provides additional liquidity to financial markets and there has not been a large wave of defaults, due to government guarantees and similar programs. It remains to be seen, how this evolves, once the government guarantees are withdrawn, which could trigger additional volatility in the market. These two indicators suggest that inflation is very likely to increase in the short-term with potentially long-term consequences. Furthermore, instead of only anticipating rising inflation, it started to effectively to show, as the US inflation rate in May has risen to 5% compared to only 1.4% in January 2021 and BoE’s Haldane has warns that inflation is expected to rise close to 4% in 2021. Figure 3 looks at inflation in recent years for selected US consumer goods and services, which have developed vastly different, even when disregarding the impact of Covid-19. For example, within the last twenty years, hospital services have doubled, whereas TVs have decreased by 90%. The overall inflation over this time frame was almost 55%. It seems to be the case that most industries that are substantially affected by the government have increased massively, whereas fewer regulatory inventions have led to decreasing prices of goods and services. However, this is not entirely objective, as three out of the four massively more affordable goods are tech related. For technological products and services, it is common that they are very expensive in the beginning but lose value very quickly and become cheap and widely accessible. In an environment, in which inflation is a huge concern, equities seem like a good way to hedge some of the inflation risk. But, its attractivity is limited, as stock markets have risen incredibly since the initial drawdown caused by Covid-19. The S&P 500, for example, is almost breaking its high on a daily basis with a high of 4,302 (as of 1st July 2021). This boom in the stock market, alongside the surge in valuations of mostly technology companies, has led to 5.2m new millionaires in 2020, as shown in Figure 4. Consequentially, equity hedge funds have done mostly very well last year, some (for example Long/Short US Equity Consumer, TMT, Healthcare) being up more than 60% in 2020. In 2021, the growth has slowed down, as our SMC Equity Strategy Index is up almost 6% as of May 2021. The best performing equity strategy is Equities US Activist Event Driven with a YTD of 26% in 2021.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed