|

Central banks continue to be in the spotlight. Over the past months, it is hard to find a central bank that has not raised interest rates at least once. Inflation remains at four-decade highs in most countries, despite the measures taken by central banks so far. The Fed raised interest rates by another 75bps this month and maintains its stance to aggressively combat inflation. This led the 2-year Treasuries to surge above 4%, for the first time since before the global financial crisis, and increases the likelihood of a recession as well as potentially sharply declining equities. The latest hike increased the federal fund rate to 3% - 3.25%. The ECB also raised its interest rate by 75bps in September, while the Bank of England increased its rate by 50bps. The ECB’s rate is now at 1.25% and the UK’s is at 2.25%. Switzerland also raised its rate by 75bps which brings it into positive territory as the last country in Europe. In the middle East, Saudi Arabia, the UAE, and Qatar follow the Fed with their 75bps hikes as well. Across the developed countries, Japan remains the last country with currently negative rates at -0.10%. September 2022 has also been highly relevant for the currency market. The dollar has strengthened substantially over the year. Compared to the Euro, it appreciated from around 0.9$/€ in 2020 to 1.03$/€. The British Pound declined strongly. The latest tax cut in the UK is threatening even higher inflation and will force the BoE to act more aggressively in tightening. After the announcement, the Pound dropped below 1.1$/£, and some speculate that the Pound could fall below parity to the USD. The Japanese Yen also experienced substantial movements, as the country is buying Yen again for the first time in nearly a quarter century. In spite of the negative developments of equities in 2022 and their even more grim prospect, equities are doing great on a historical scale. Figure 1 shows the growth of global equities with the impact of several crises

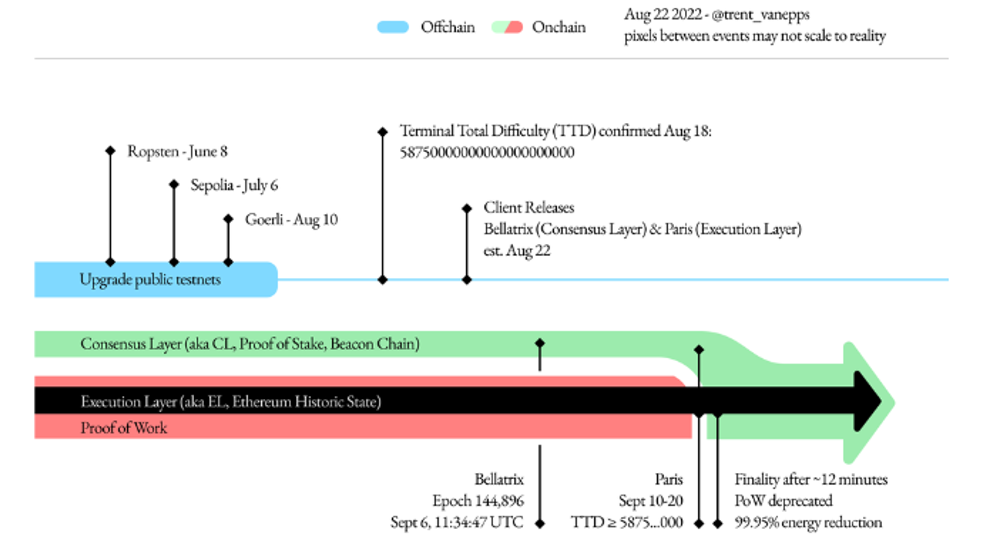

Macro news still continues to drive markets. Europe is at the center in early September. At the end of August, Europe’s inflation soared to another record this year at 9.1%. This increase is largely due to ever-soaring energy and food prices. A week after the release of inflation data, the ECB raised interest rates by 75bps which raises its base interest rate to 1.25%, still far off from other countries, such as the US or the UK. A recession in Europe is getting more and more likely with such announcements. This threat is especially high for the UK, as Goldman Sachs expects the recession to start in the UK in the fourth quarter. The UK faces the same issues as Europe does, but at an elevated pace. UK’s inflation is higher than 10% while the BoE has raised interest rates significantly more this year already. While the current base rate is only marginally higher at 1.75%, another decision in early September was delayed following the passing of the Queen last week. The weak currencies are another issue. Both, the Euro and the British Pound, are exceptionally weak compared to the US Dollar historically. In the US, the situation seems a bit more stable. Last month, the US managed to re-employ all people fired during Covid-19, and the country continues to employ more people, leading to a record low unemployment rate. However, markets are still heavily pressured by the hawkish Fed. The board emphasized that they are strongly committed to bringing inflation down soon rather than later. Markets widely expect at least another 50bps if not a 75bps hike in the next meeting. Another major development takes place in the cryptocurrency market. “The merge” of Ethereum (ETH) will be executed around the 15th September 2022. Essentially, the merge refers to the combination of the ETH main-chain and its side-chain, known as Beacon chain (launched in December 2020). The main-chain is based on the PoW (Proof-of-Work) consensus algorithm, whereas the Beacon chain uses PoS (Proof-of-Stake). The difference between the two validation algorithms is the resulting energy cost. PoW uses computational power to validate the network. In this approach, all computers try to validate a transaction, in which the fastest is rewarded. Unsurprisingly, this leads to a lot of unnecessary energy consumption. PoS also uses computational power to validate transactions but it bundles the computers together and everyone gets a fraction of the reward. This prevents energy consumption for nothing and leads to an energy consumption decrease of more than 99.9%. Figure 3 summarizes the timeline of the merge. While it is unlikely that there will be a large move in ETH immediately after it takes place (assuming it works well), such events have historically been followed by strong performances of the underlying chains. One example is the introduction of the Beacon chain in December 2020, after which ETH rose from $400 to almost $4,000 in less than six months. Cryptocurrencies were relatively stable and gained slightly over the past weeks. Bitcoin is currently trading at $22k and ETH is valued at $1,750.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed