|

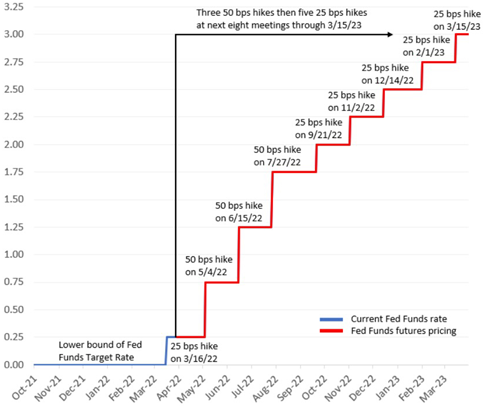

Aside from the continuous news about the ongoing war between Russia and the Ukraine, macro events are increasing after they have been halted when the war started. Central banks will increase the interest rates gradually over the year to combat the steadily rising inflation. After Powell announced at the beginning of the year that there will be many, but small, interest rate hikes in 2022, equity markets lost substantially. The first interest rate hike was expected early on but was postponed and again when the war started. Even though the war is ongoing, in mid-March 2022, the Fed announced the first 25bps hike. In a statement a week later, Powell showed a more aggressive stance to get inflation under control by outlining the plan of six further 25bps hikes in 2022, which will take place after each meeting. For May, he outlined that there is a high chance that the hike may even be 50bps. Figure 1 summarizes the expectations of the interest hikes in the coming year. These planned hikes pose a major treat for an inversion of the yield curve, as the spread between 2y and 10y notes dropped to only 13bps as of last week. On Monday, the 28th March 2022, the yield curve inverted as the yield on the 5-year notes rose above the yield of the 30-year note. In all prior Fed tightening cycles since 2000, the yield curve inverted. This is particularly relevant, as this was just the first of planned seven hikes this year and the decline in the spread between short- and long-term rates has rarely been that quick. As a sign of a recession, it remains to be seen whether this scenario unfolds against Powell’s view of a flourishing economy, due to increased interest rates. Figure 2 shows the previous yield curve inversions since 2000. Increased interest rates also increase the attractivity of bonds, as they will generate returns again. Since Covid-19 when interest rates were basically zero at all times, attractivity of bonds substantially decreased which led to soaring equity market as bonds were no longer viable alternatives. It also fuelled the commodity rally, as bonds did not provide an alternative to manage inflation concerns. This led to many commodities reaching all-time highs at some points since Covid-19 emerged. The interventions of central banks to mitigate the economic effects of Covid-19 have caused an extreme situation and most macro variables are at record levels, or at least at a record level of a long timespan, as shown in Figure 3. Inflation is the major concern for central banks in 2022, as, for example, inflation reached 7.9% in the US in February. Europe is not doing much better, especially given the context of steep increases months later than in the US. While the ECB is holding interest rates for at least until the latter half of 2022, the BoE has increased interest rates three times already in 2022. The latest hike came in mid-March 2022 and was the third consecutive meeting in which interest rates were raised by 25bps each which results in rates of 0.75%. This also makes the BoE the first central bank to set its interest rate to pre-Covid levels. Now, the tone in terms of a tightening policy has been reduced to balance the impact of inflation and the economy, especially because of the soaring gas and oil prices from the Russia-Ukraine conflict. Figure 4 shows a summary of the CPIs of the UK over the past year and emphasizes the steep increase in most measures. The BoE also adjusted its forecast upwards to an average inflation of 8% in Q2 2022.

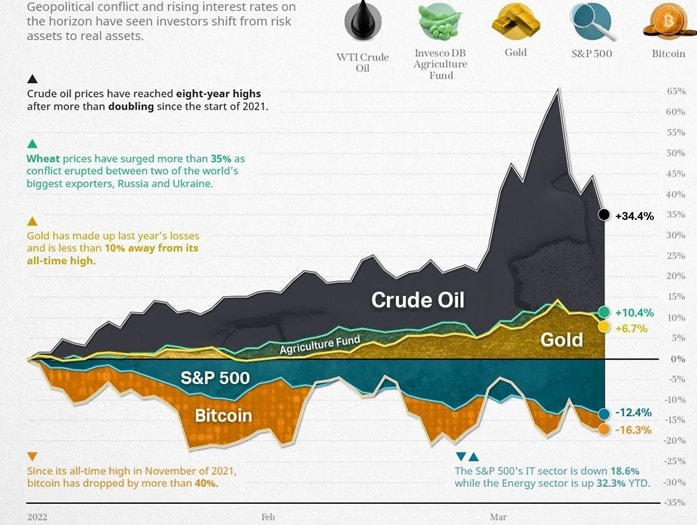

Russia’s invasion of the Ukraine certainly did not work as planned by Russia. They vastly underestimated the resilience of the Ukrainian people and the worldwide support they have received which included money, weapons, ammunition and even soldiers among others. The sanctions imposed by most countries also have hit Russia hard which supposedly is on the brink of defaulting. Russia has suffered substantial losses in the war and Putin had to impose severe measures to shield the Russian people from worldwide news coverage. The Russian government imposed a new law for news broadcasting which made nearly all international news stations leave the country. Moreover, Russia banned many Western internet companies similarly to China. Russians are facing the dire consequences of the war, as the country is starting to run out of certain goods as well as seeing significant price increases. Nonetheless, for Ukrainians the situation is even worse, as there have been more than 1,500 civilian casualties and more than three million already left the country. Due to the resilience of the Ukrainians and the sanctions from the West, it is questionable for how long the war can continue, as Putin is likely to face more pressure from the citizens of Russia. This leads to a dangerous situation, as Putin and Russia are likely to lose substantially even if they manage to take control of Ukraine. Putin threatened the use of nuclear warheads if the worldwide interventions should continue or the NATO would step in. This threat is especially concerning, if Russia’s defeat should become apparent, even from Russia’s perspective in which case Putin has “nothing to lose”. Amplified by the war, inflation is continuing to rise. In the US, inflation rose to 7.9% in February 2022, while Europe’s inflation increased to 5.8% and 5.5% in the United Kingdom. In order to combat this development, central banks started to raise interest rates this year. The Bank of England announced its second interest raise, while the Fed announced its first interest rate hike of 2022. Both banks are expected to increase interest rate several times in 2022. Oppositely, the ECB announced that there is still space before an interest rate hike is necessary and first interest rate hikes are expected in the latter part of 2022. Figure 1 shows a summary of several assets and their performance in 2022 which strongly differs across the assets. Top performers are commodities. Crude oil is up 35% in 2022 after being up more 65% earlier in March. Crude oil topped $130 per barrel at one point in March 2022 but substantially declined in value, as it was announced that supply will be increased. Since then, crude oil is hovering between $95 and $110 per barrel. Agriculture funds also gained substantially. Wheat was a major contributor to this development, as wheat doubled from the prices one year ago. Since its peak in March 2022, the asset lost around 10-15% in value. Gold is another asset that surged and regained its losses from the past year and is close to its previous all-time high from August 2020. Figure 2 shows a summary of the performance of selected commodities. Most profitable were the commodities that are reliant on the Ukraine and Russia. Russia is a key player in oil, gas and palladium, while the Ukraine is a large supplier of wheat. These assets have skyrocketed, while other commodities still increased but only slightly. Although the increases in gold and copper seem underwhelming, both assets are trading at record or close to record highs. Equities are a lot more volatile and the broad markets suffered a substantial loss once the war started and keep declining at a relatively stable pace. Nonetheless, the success is largely dependent on the industry. Unsurprisingly, energy stocks are doing incredibly well, as they are up 32% in 2022. Tech stocks face substantially more issues and are down almost 20% in 2022 so far. This development stems from the correction of the huge gains in 2020 and 2021 and their high upside potential which is great if the economy is stable. If the economy faces a lot of uncertainty, these stocks suffer most, as is evident in the current situation. Lastly, Bitcoin (BTC) that is frequently referred to as digital gold could not maintain this status, as it is down significantly since the start of the war. It experienced substantially more volatility than most other assets during this time. Since the first few days in 2022, BTC is continuously trading between -5% to -25% compared to the value at the beginning of 2022. The industry gained a couple of percentages following the EU parliament’s approval of a crypto legislation but quickly lost this gain again. Nonetheless, the asset class is well positioned in the current ecosystem, as inflation is still rising and institutional adoption has increased a lot. Currently, 99% of transactions in BTC are from institutions. The performance of cryptocurrencies currently largely favours the big and well-known cryptocurrencies. BTC and Ethereum (ETH) have lost relatively little over this time period, whereas many other smaller cryptocurrencies, e.g. Solana (SOL), dropped by more than 50% since the beginning of the year. This highly uncertain ecosystem also favours hedge funds. The AuM of the industry soared to a record $4.8tn at the end of 2021 and it is unlikely that interest will decline. In particular, macro hedge funds are posting huge gains and attract further capital. Additionally, due to volatility, more investors deciding to put money in hedge funds rather than stocks and bonds.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed