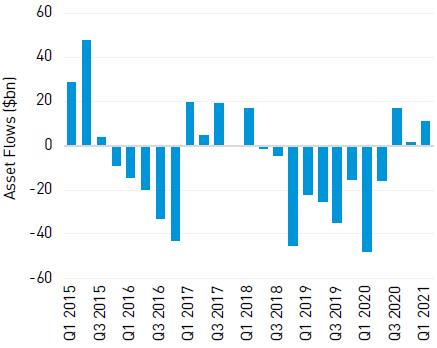

Hedge funds are doing great in 2021. Hedge funds’ AuM has surpassed the $3.8tn mark in March 2021, which is backed by several reasons. The more negative view on hedge funds over the last five years have subsided, since they have mitigated the financial impact of Covid-19 and posted strong performances afterwards. This boosted the AuM through the performance as well as additional inflows caused by the good results. This is very likely to continue, since hedge funds have had their best Q1 return for more than two decades. Alternative investments in general did very well. Private equity was slowed down initially by Covid-19, but their recovery returns were extremely strong. The high valuations on the stock market certainly helped to achieve this return. Private debt did well too, although their initial recovery was slower. But due to the favorable interest rates, private debt seems attractive compared to public debt. Commodities are doing well too, especially considering their relatively bad performance over the last decade. Gold gained significantly since 2019, which was further boosted by the money printing following Covid-19 and surged to a record of $2k per ounce, but since then, it lost again and has been very stable at around $1.7k over the last months. Oil, which was hit very hard during the initial Covid-19 reactions, has reached its level prior to the crisis and continues to reach higher prices. Just in the last month, WTI crude oil gained more than 10% and is currently at $66 per barrel. Industry metals also have gained substantially in 2021 and due to their demand, it is likely that this will continue. Cryptocurrencies have gained again over the last two weeks. Bitcoin (BTC) was not that specular, as remains between $50k and $60k, despite dropping quickly below the $50k mark. Nevertheless, BTC is still up 91% in 2021 and its market cap remains above $1tn. The big mover was Ethereum (ETH), which was around $2,500 before its surge starting in early May. It peaked above $3,400 and is currently at $3,350. ETH is up 349% in 2021 and almost has a market cap of $400bn. Figure 5 shows the ETH price (in green) from 2020 onwards and its value in BTC (yellow line). During 2020, the two coins moved similar, but since 2021, ETH is outperforming BTC substantially. At the end of 2020, ETH was worth less 0.03 BTC, whereas now it is worth more than 0.06 BTC per coin. Other altcoins followed ETH, but not to same extent. Thus, the crypto market, of which 70% was BTC in 2020, known as “Bitcoin dominance” is shrinking. Currently, BTC only accounts for 45% of the market capitalization of the crypto market.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed