|

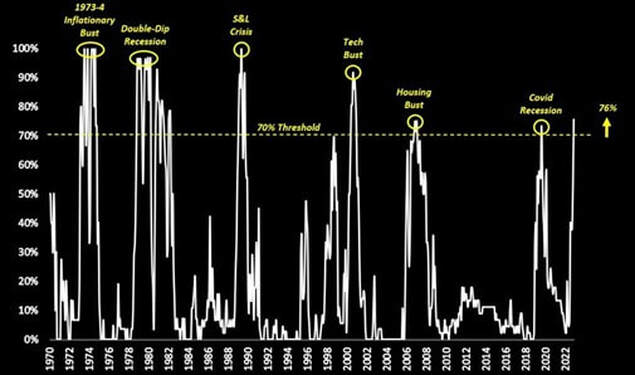

Although there is a recession looming, markets started well in the fourth quarter. In particular, equities were able to recover some of their losses during the year. This development largely stems from the better-than-expected inflation report in the US. The inflation dropped to 7.75% compared to more than 8% for the past couple of months. The strong stance on interest rate hikes by the Fed seems to show an impact finally. However, this development needs to continue until inflation is back under control. While this development is a good indicator, the threat of a recession is far from over. For example, the yield curve does not look healthy at all, which has been the case for a while now. Figure 1 shows the current yield curve inversion in percentage relative to the inflationary bust in 1973/74. It suggests a strong possibility of a recession, as there always was a recession if the current threshold was surpassed. Nonetheless, with the inflation “cooling”, there might be a chance to avoid such a recession. The largest shock occurred in the cryptocurrency market. With the bankruptcy of FTX, one of the largest centralized exchanges, the industry took a huge hit. Just a few months ago, the company was in talks of raising another $1bn at a valuation of $32bn. The company collapsed after a liquidity shock. Documents in the bankruptcy filing reveal that the company had less than $1bn in assets compared to more than $9bn in liabilities. Initially, it seemed as if Binance, the largest centralized cryptocurrency exchange, might buy FTX. However, Binance decided against this endeavor. Following these events, the cryptocurrency market took a substantial hit. Bitcoin dropped to below $16k, and Ethereum fell lower than $1.2k. Since then, the market has remained relatively stable close to its lows. Figure 2 shows the price development of Bitcoin over the past three months. Nonetheless, the crypto market remains of interest. There is substantial interest from institutional investors, and the new lows offer good entry points for VCs, especially as they are under pressure to deploy capital. In the recent past, VCs have committed substantial amounts to crypto startups and emerging companies. Among these emerging technologies, the metaverse has the potential to become a significant industry. McKinsey estimated that the metaverse could be valued at up to $5tn by 2030, as shown in Figure 3. They see high potential in e-commerce, banking, telecom, and retail, among other industries.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed