|

The cryptocurrency industry starts in 2024 with a massive win. The SEC approved multiple spot Bitcoin ETFs on Wednesday (10th January 2024). This is a major development of the industry’s adaptation to the broad financial markets and institutional investors in particular. While there were already multiple relevant ways to obtain crypto, e.g. through mutual funds, Bitcoin Futures ETFs, and Grayscale’s Bitcoin Investment Trust, it brings more regulatory clarity to the industry, which is still an important issue and prevents some investors from entering the space. This could also open the door for further crypto ETFs, such as Ethereum ETFs, in the future. However, the SEC clearly stated this approval does not constitute an opinion on cryptocurrencies as a whole or any individual tokens, which remain largely considered investment contracts that fall under the federal securities law.

This development is especially notable, due to the amount of time it took. In 2013, the Winklevoss twins filed for a Spot Bitcoin ETF, which was denied in 2017. Many other ETF providers filed for approval during the following years, which were also declined. In August 2021, the Chair of the SEC mentioned that they would look favourably on ETFs based on Bitcoin Futures instead of spot Bitcoin, largely due to the underlying regulatory clarity futures provide over cryptocurrencies. Following this development, the first Bitcoin Future ETFs were approved in October 2021. Then in 2022, Grayscale Investment filed for a potential conversion of the Bitcoin Trust to an ETF, which the SEC declined. Following this decision, Grayscale sued the SEC for their “arbitrary and capricious” explanation. In August 2023, judges ruled in favour of Grayscale, which led to increasing optimism on spot Bitcoin approvals and the eventual approval in 2024.

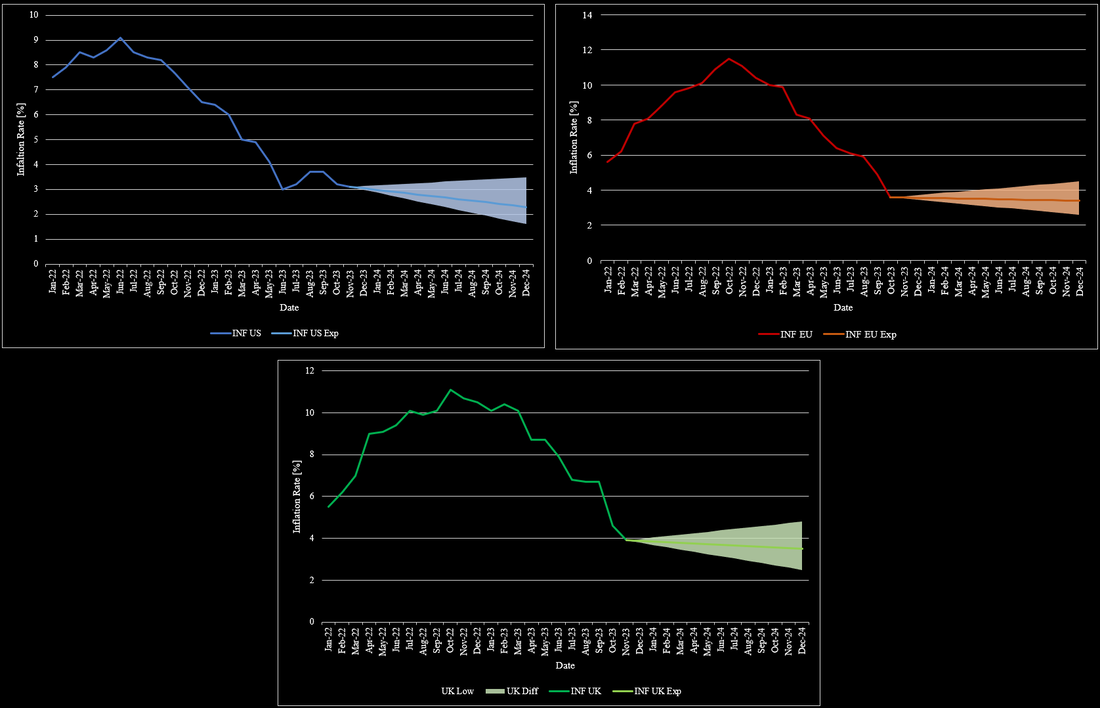

Inflation and interest rates have been present topics. Inflation rates have continuously decreased throughout 2023 across most economies. While this development was promising, it was necessary as inflation rates went as high as almost 12% towards the end of 2022. In the US, inflation has decreased to 3%-4% in the past few months with no particular direction since then. For 2024, it is widely expected that inflation will decrease further, albeit to a limited degree. Most market participants expect inflation to be around 2.3% by the end of 2024. Others see inflation to drop to as low as 1.6%. Assuming no further geopolitical crises and no further escalation of existing crises, inflation is unlikely to rise further than 3.5% by the end of 2024. Figure 1 shows the development of inflation rates in the US, UK, and the EU from January 2022 to the end of 2024. The general sentiment that inflation rates should fall is intuitive given the high interest rates at this time. In the EU, the development has mostly mimicked the US, but with a delay of a couple of months, due to a more restrictive central bank policy when Covid-19 emerged. Inflation in the EU has also reached a point, where inflation is no longer declining at levels slightly below 4% after being at 10% at the beginning of the year. For 2024, inflation is also expected to further fall, but not to the same degree as in the US. Expectations for inflation in the EU range from 2.6% to 4.5% with the most likely level around 3.4%. The situation in the UK also drastically improved towards the end of the year. UK’s inflation fell to 4% after lingering around the 10% mark for almost an entire year. Inflation expectations for the UK are mostly equivalent to the EU’s expectations, but its projections are more volatile based on the country’s state over the past few years.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed