|

Cryptocurrencies started phenomenally in the year 2024. To date, Bitcoin (BTC) is up almost 50% in 2024 after soaring around 160% in 2023 already. On 28th February 2024, BTC managed to surpass the $60k mark and peaked at nearly $64k. With the Halving on the horizon, BTC will likely surpass its previous record high of $68k set in November 2021. Ethereum (ETH) and other altcoins are following the price development of BTC after the most recent hype around the BTC ETF approval showed a relatively small impact on other coins. ETH is also up almost 50% in 2024, at the time of writing. ETH is currently trading at $3,385, levels last seen in early 2022. While BTC is already relatively close to its record high from 2021, ETH is still quite far away from its record high of $4.8k from November 2021. The growth of Solana (SOL) has slowed in 2024, gaining only 16%. Nonetheless, the current level of $118 was last seen in early 2022, when the token crashed substantially amid the general crypto crash and reliability issues of the network. Although the growth over the past two months has not been exceptional, this is more than compensated by the 10x return in 2023. While BTC and ETH show a tendency for a new record level soon, SOL still needs to grow substantially to overtake its previous record high of $260 in November 2021. Figure 1 shows the price development of the three coins from the end of 2021 to February 2024. The most recent surge in prices also resulted in the market capitalization of cryptocurrencies rising above $2tn for the first time since early 2022. Currently, the market cap of the industry lies at $2.33tn.

Cryptocurrencies started phenomenally in the year 2024. To date, Bitcoin (BTC) is up almost 50% in 2024 after soaring around 160% in 2023 already. On 28th February 2024, BTC managed to surpass the $60k mark and peaked at nearly $64k. With the Halving on the horizon, BTC will likely surpass its previous record high of $68k set in November 2021. Ethereum (ETH) and other altcoins are following the price development of BTC after the most recent hype around the BTC ETF approval showed a relatively small impact on other coins. ETH is also up almost 50% in 2024, at the time of writing. ETH is currently trading at $3,385, levels last seen in early 2022. While BTC is already relatively close to its record high from 2021, ETH is still quite far away from its record high of $4.8k from November 2021. The growth of Solana (SOL) has slowed in 2024, gaining only 16%. Nonetheless, the current level of $118 was last seen in early 2022, when the token crashed substantially amid the general crypto crash and reliability issues of the network. Although the growth over the past two months has not been exceptional, this is more than compensated by the 10x return in 2023. While BTC and ETH show a tendency for a new record level soon, SOL still needs to grow substantially to overtake its previous record high of $260 in November 2021. Figure 1 shows the price development of the three coins from the end of 2021 to February 2024. The most recent surge in prices also resulted in the market capitalization of cryptocurrencies rising above $2tn for the first time since early 2022. Currently, the market cap of the industry lies at $2.33tn.

2023 followed the core theme of 2022 with a key focus on inflation and interest rates. At the beginning of 2023, inflation was a huge concern, due to its high level. In the US, inflation was at 6.5% and already declined substantially from its peak in June 2022 at 9.1%. This trend continued in 2023 until it reached its bottom in June 2023 at 3%. Since then, US inflation remained steady between 3% and 4%. The EU and the UK saw a very similar development of inflation throughout 2022. Their respective inflation started at around 5.5% in January 2022 and rose to 10.5% by the end of 2022. As soon as 2023 started, inflation in the EU started to decline and eventually declined to as low as 3.1% in November 2023. Despite this promising development, inflation began to increase again to 3.4% in December 2023. While the UK’s inflation development was almost equivalent to the EU’s in 2022, this changed in 2023. Inflation in the UK remained above 10% until April 2023, at which point inflation was at 10% or higher for almost an entire year. Nonetheless, UK inflation also came down later in 2023 and reached the 4% mark at the end of December 2023. Based on the overall relatively similar development of inflation around the world, it is likely that inflation will stay at elevated levels in the short term. Another key reason for relatively stale inflation is that central banks stopped hiking their interest rate for a while now in 2023. Figure 1 summarizes the development of inflation in the US, EU, and the UK.

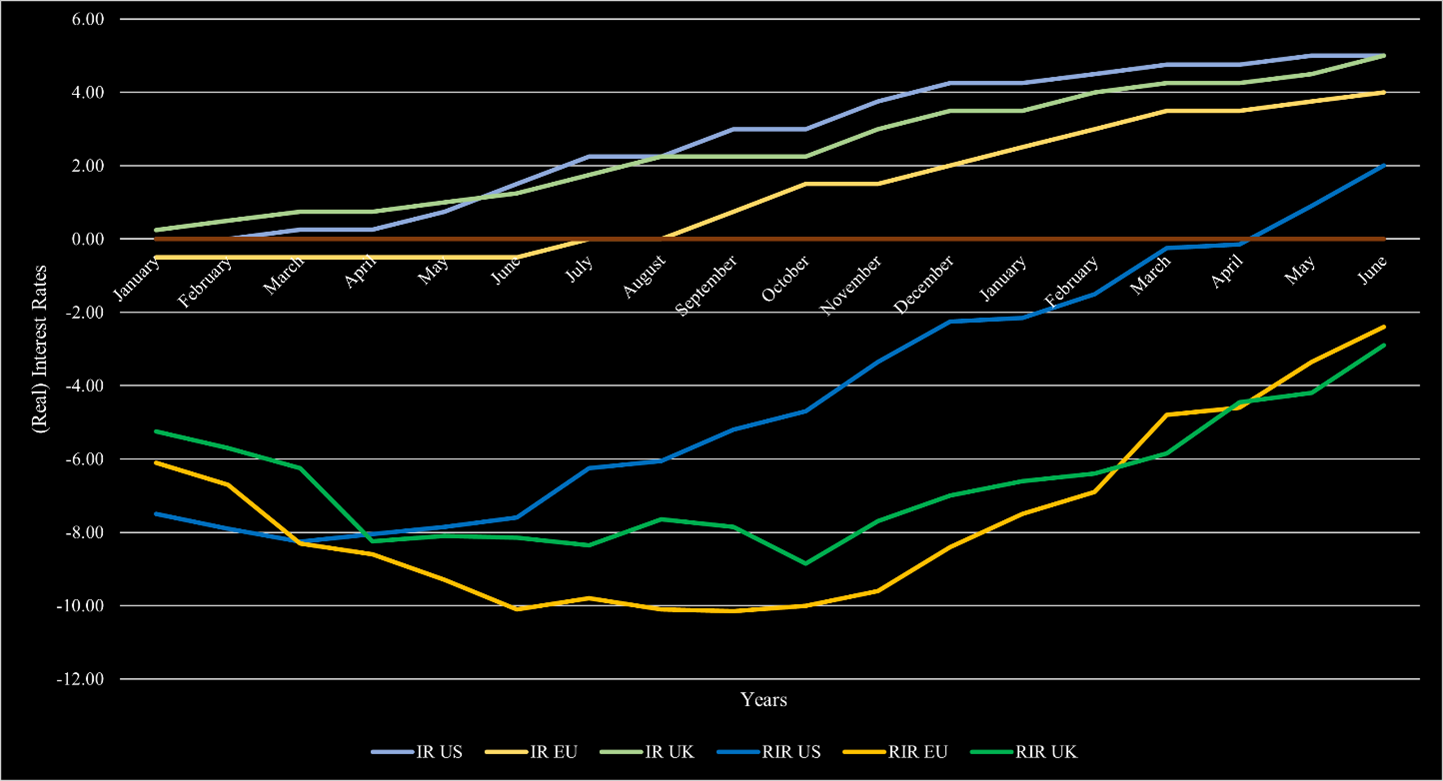

With the soaring inflation in 2021 and afterward, central banks had to react. Financial markets enjoyed rates close to zero, if not negative, for a long time. As a response, central banks started raising their interest rates. The Bank of England was the first to raise its interest rates in December 2021. The Fed followed in March 2022 and hiked its rate in every meeting and by a higher amount on average than the BoE or the ECB. The BoE did so too, but did smaller hikes on average. The ECB followed in June 2022, but they did not hike at every meeting. At the start of 2023, the interest rate in the US was already at 4.25% compared to 3.5% in the UK and 2.5% in the EU. Consequentially, the ECB hiked more in 2023 but did not reach the same heights as in the US or UK, which are currently at 5.25%, while the ECB’s interest rate remains at 4.5%. With interest rates now higher than inflation rates in each of those economies, most market participants expect interest rate cuts in 2024, especially due to an elevated possibility of a recession ahead.

The current macroeconomic volatility has not changed. Interest rates and inflation remain elevated. At least in most markets, the inflation rate is continuously declining. In the US, inflation reached 3% and is on its way to the upper target of 2% in the short-term. Europe is following this development but still has a substantial way ahead before inflation will eventually reach those levels, as inflation remains at 6.4%. In the UK, the situation is more dire and inflation declined to 7.9% after being above 10% since August 2022. In order to bring inflation levels down, central banks have hiked substantially over the past 1.5 years. In the US, the federal fund rate is now above 5.25% with the most recent hike, which has largely been deemed unnecessary by market participants. The ECB also increased its interest rate by 25bps and is now at 4.25%. The BoE also raised its core interest rate by 25bps in their latest meeting and is now equivalent to the US’s 5.25%. The US also reached the status of positive real interest rates since the hikes started. Europe and the UK are following this trend but have not reached this territory yet. Figure 1 also shows how Europe and the UK are lacking behind the US. In the current environment, a recession is still likely. While projections have changed throughout the year, the consensus opinion remains that there will likely be a short and with a shallow to medium impact on the economy. The most notable change is that the recession expectation has pushed further and further into the future. It started with estimations that it will happen by mid-2023, then towards the end of 2023. Now, most estimates place the recession somewhen in 2024.

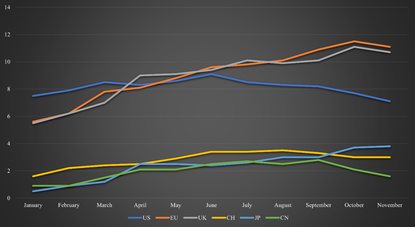

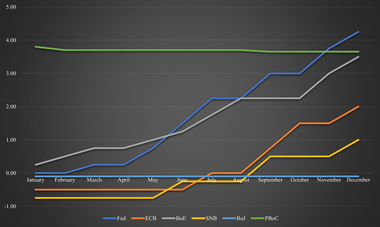

Inflation was a core issue in 2022 and remains to be one in 2023. In the US, inflation started to decline in the summer of 2022 and remains currently at a level of 7.1%. Contrarily, in Europe and the UK, inflation remains a huge issue and has barely declined from its peak in 2022. It remains at 11.1% for the EU and at 10.7% for the UK. The difference between the inflation can largely be attributed to two factors. Firstly, the Fed hikes interest rates more aggressively than its European counterparts. This led to a quicker response to inflation. Secondly, Europe is more directly affected by the war between Russia and Ukraine and is largely dependent on Russian oil and gas, which soared in price following the war. Contrarily to other European countries, Switzerland managed to keep inflation relatively low with a peak in late summer 2022 at 3.5% and 3% currently. Switzerland managed to avoid high inflation due to its strong currency and relatively low demand for fossil fuels, as most of its electricity stems from hydropower and nuclear power. In Asia, both Japan and China also experience limited inflation issues. Japan achieved this through its central bank which continuously intervenes with large-scale monetary easing. Despite the low inflation, Japan is still suffering, as wages remain stagnant unlike in other major economies where it helps offset the higher inflation to some degree. China does not face an inflation problem, due to their different handling of the Covid crisis. Unlike most economies, they did not provide large stimuli to the economy. Additionally, their zero-Covid policy substantially reduced household demands. Figure 1 shows a summary of the inflation rates across the highlighted economies during 2022. Regarding 2023, it is widely expected that inflation, especially in high-inflation countries, will come down. For instance, in the US, it is expected that inflation will be around 4% on average, and close to the 2% Fed target by the end of the year. Inflation forecasts in the EU and the UK are more difficult to estimate, due to their dependency on the war and its outcome. Additionally, unlike in the US, inflation has not really started to decrease. Assuming further strong interventions by the European central banks, it is expected that inflation will drop substantially. The ECB expects the average inflation to be around 5%-6% during 2023 with inflation slightly below 4% by the end of 2023. In the short term, Europe will be under pressure and the measures take time to become effective, as shown in the example of the US. Despite a similar outlook to the US, albeit with a delay of around half a year, it is less promising. One important wildcard is energy prices, which are strongly linked to the war. While the EU managed to get its oil largely from other sources than Russia, it still needs Russia, and gas is not as easily substitutable. With the prospect of Russia’s supply cut and China reopening, prices of energy sources are likely to increase. Depending on the scale, if it occurs, the anticipated target may not be reached and inflation will remain higher than the target. In Switzerland, inflation is expected to remain around the 3% mark for 2023. Given the strong involvement of the BoJ, Japan’s inflation is expected to end the year 2023 below the 2% inflation mark. It is additionally expected that wages will rise for the first time in three decades. Inflation in China is expected to rise to around 2% in 2023. This is a combination of the reopening of the economy and the end of the zero-Covid policy. This will lead to an increase in economic activity and the necessity for further energy. Additionally, the price pressure across will also be felt in China, once demand picks up again. The interest rate hikes by most countries have been another crucial topic during 2022. So far, the hikes have shown limited effectiveness in dealing with soaring inflation. In high-inflation countries, it was effective for the US and had little impact on the European countries. However, this discrepancy is likely due to the steeper hikes in the US and less dependency on the war by the US. The US employed the strongest measures, as it hiked from 0% at the beginning of 2022 to 4.25% at the end of 2022. In contrast, the ECB just started hiking in June 2022 at -0.5%, which increased to 2% by the end of 2022. The BoE employed a mixture of the two. The UK started hiking at the end of 2021 but hiked in smaller steps than the US. Towards the end of 2022, it increased the step size and is currently at 3.5%. Switzerland started hiking earlier than the ECB, despite substantially lower inflation. Switzerland’s prime rate became positive for the first time in years in September 2022. Currently, the prime rate is sitting at 1%. Japan was one of the exceptions, as the BoJ did not hike at all. Its prime rate remains at -0.1%. However, the central bank still strongly intervened in the market as elaborated previously. The People’s Bank of China even lowered its prime lending rate over 2022, albeit to a minimal degree. Currently, the rate is at 3.65%. There is a strong consensus for the year 2023 in the US and Japanese markets. Most market participants expect the Fed to keep raising interest rates to around 5%-5.25%. The Fed is likely to do this in smaller steps than previously. Nonetheless, this level should be reached by the end of Q1 2023. Afterward, a majority of institutions do not expect further hikes or cuts in 2023. The remainder anticipates potential interest rate cuts in Q4 2023. The exact outcome of potentially further hikes or cuts largely depends on the state of the US economy in the latter part of 2023. While the measures seem to be effective and inflation is going down considerably, the risk of a recession is considerable. This largely stems from substantially higher financing costs for businesses, and lower demand from consumers as Covid reserves are exhausted and households feel the pressure from the inflation over the past year. Given that the BoJ has not intervened by raising interest rates, it is not expected that it will in 2023. It is more likely that it will continue its qualitative and quantitative easing philosophy employed so far. In particular, as Japan does not face an imminent inflation problem. With expected wages adjusted, the pressure of inflation should also be eased without a strong necessity to make policy adjustments. For the EU, it is expected that rates will be hiked further to combat the prevalent inflation. Market participants expect interest rates of around 3%, which should be reached during Q2 2023. For the UK, additional hikes of 1% are expected, resulting in interest rates of around 4.5% for 2023. For both economies, no rate cuts are expected in the latter half of 2023. In Switzerland, the SNB is anticipated to hike another 0.5% in 2023 with no rate cuts as well.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed