|

Although oil prices were relatively steady at moderate to high levels over the past year, prices started increasing. Most recently, a potential intervention by Iran in the conflict in Israel led oil to surge further in price. At its peak in 2024, WTI crude oil traded at nearly $88 per barrel, which fell slightly to the current level of $86 per barrel, as shown in Figure 1. This decline is attributed to the current view that Iran has refrained and is expected to continue to refrain from getting involved in the conflict. Nonetheless, geopolitical tensions in the Middle East pose a significant threat to oil supply and could result in price shocks should the current situation escalate. Excluding major escalation, it is likely that oil will remain relatively stable throughout 2024 with limited upside and downside potential. The current economic situation and at least the short-term outlook appear to be beneficial for oil demand. Improved manufacturing data from the US, China, and India boost the requirement for oil. Interest rate cuts on the horizon are likely to boost economies, which also results in higher oil demand. On the supply side, the OPEC+ held the supply relatively tight to maintain moderate to high prices for oil. In case oil should move significantly higher, production would likely increase from the OPEC+, as it would push alternatives which hurts oil's long-term outlook. Nonetheless, in the case of escalations, especially in the Middle East, supply could be constrained, which could result in strongly soaring oil prices that cannot be resolved quickly.

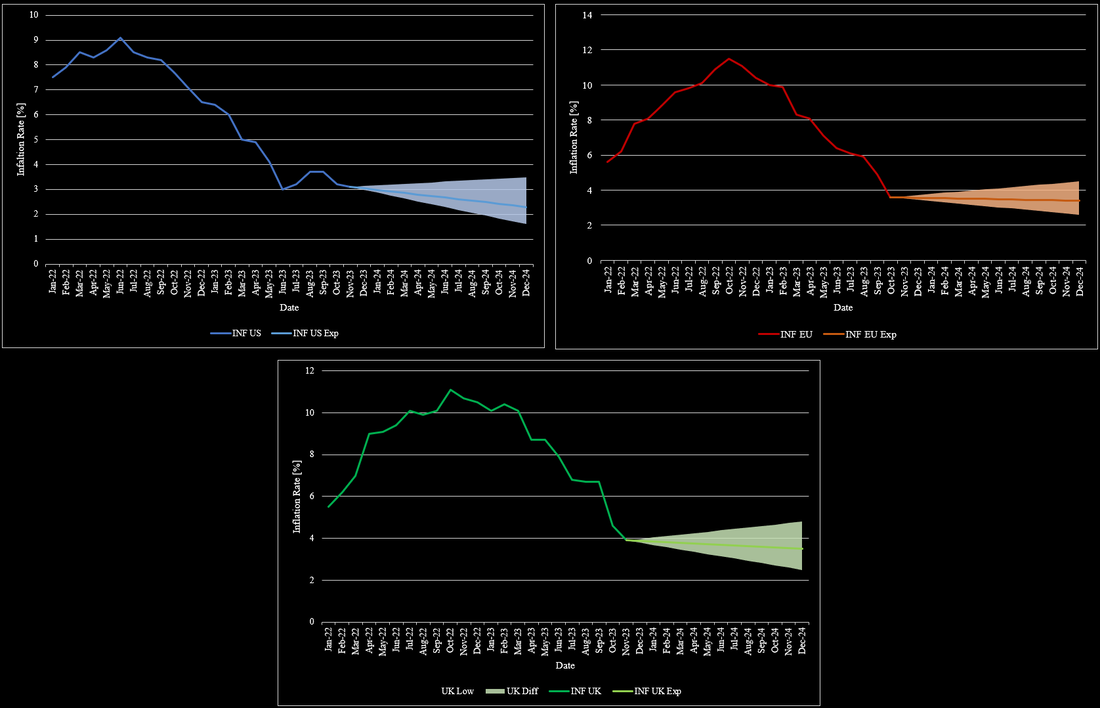

2023 followed the core theme of 2022 with a key focus on inflation and interest rates. At the beginning of 2023, inflation was a huge concern, due to its high level. In the US, inflation was at 6.5% and already declined substantially from its peak in June 2022 at 9.1%. This trend continued in 2023 until it reached its bottom in June 2023 at 3%. Since then, US inflation remained steady between 3% and 4%. The EU and the UK saw a very similar development of inflation throughout 2022. Their respective inflation started at around 5.5% in January 2022 and rose to 10.5% by the end of 2022. As soon as 2023 started, inflation in the EU started to decline and eventually declined to as low as 3.1% in November 2023. Despite this promising development, inflation began to increase again to 3.4% in December 2023. While the UK’s inflation development was almost equivalent to the EU’s in 2022, this changed in 2023. Inflation in the UK remained above 10% until April 2023, at which point inflation was at 10% or higher for almost an entire year. Nonetheless, UK inflation also came down later in 2023 and reached the 4% mark at the end of December 2023. Based on the overall relatively similar development of inflation around the world, it is likely that inflation will stay at elevated levels in the short term. Another key reason for relatively stale inflation is that central banks stopped hiking their interest rate for a while now in 2023. Figure 1 summarizes the development of inflation in the US, EU, and the UK.

With the soaring inflation in 2021 and afterward, central banks had to react. Financial markets enjoyed rates close to zero, if not negative, for a long time. As a response, central banks started raising their interest rates. The Bank of England was the first to raise its interest rates in December 2021. The Fed followed in March 2022 and hiked its rate in every meeting and by a higher amount on average than the BoE or the ECB. The BoE did so too, but did smaller hikes on average. The ECB followed in June 2022, but they did not hike at every meeting. At the start of 2023, the interest rate in the US was already at 4.25% compared to 3.5% in the UK and 2.5% in the EU. Consequentially, the ECB hiked more in 2023 but did not reach the same heights as in the US or UK, which are currently at 5.25%, while the ECB’s interest rate remains at 4.5%. With interest rates now higher than inflation rates in each of those economies, most market participants expect interest rate cuts in 2024, especially due to an elevated possibility of a recession ahead.

Inflation and interest rates have been present topics. Inflation rates have continuously decreased throughout 2023 across most economies. While this development was promising, it was necessary as inflation rates went as high as almost 12% towards the end of 2022. In the US, inflation has decreased to 3%-4% in the past few months with no particular direction since then. For 2024, it is widely expected that inflation will decrease further, albeit to a limited degree. Most market participants expect inflation to be around 2.3% by the end of 2024. Others see inflation to drop to as low as 1.6%. Assuming no further geopolitical crises and no further escalation of existing crises, inflation is unlikely to rise further than 3.5% by the end of 2024. Figure 1 shows the development of inflation rates in the US, UK, and the EU from January 2022 to the end of 2024. The general sentiment that inflation rates should fall is intuitive given the high interest rates at this time. In the EU, the development has mostly mimicked the US, but with a delay of a couple of months, due to a more restrictive central bank policy when Covid-19 emerged. Inflation in the EU has also reached a point, where inflation is no longer declining at levels slightly below 4% after being at 10% at the beginning of the year. For 2024, inflation is also expected to further fall, but not to the same degree as in the US. Expectations for inflation in the EU range from 2.6% to 4.5% with the most likely level around 3.4%. The situation in the UK also drastically improved towards the end of the year. UK’s inflation fell to 4% after lingering around the 10% mark for almost an entire year. Inflation expectations for the UK are mostly equivalent to the EU’s expectations, but its projections are more volatile based on the country’s state over the past few years.

The month of November has been quite successful for equities and bonds alike. With the stabilizing macroeconomic landscape, markets have adjusted to the current state with high rates and moderate to high, but decreasing, inflation. In the past month, there were promising signs that no more hikes are necessary to combat inflation. A notable percentage of market participants is even optimistic about rate cuts soon. While US inflation has gone down substantially already in summer, European countries are following and are on their way to similar levels as the US. Unsurprisingly, this led to a more positive view on longer-term rates. This was evident in falling yields for longer-term bonds. US and UK 10-year bonds’ yield decreased by around 10% since October, while German 10-year bonds decreased by almost 25%. Figure 1 summarizes the development of 10-year yields from October in the previously mentioned countries.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed