|

Hedge funds experienced a great Q3 2021 and October 2021, as the average fund gained 1.68% and the majority achieved profits. In particular discretionary macro hedge funds gained substantially and according to JPMorgan the outlook for 2022 looks exceptionally promising for macro hedge funds. The market ecosystem is favourable, as there is considerable volatility in the market. A large, and concerning, driver is inflation that keeps rising for the entire year, although it was not a widely discussed topic at the beginning of the year. In November, the US CPI reached a new 30-year high after having stabilized since summer 2021. Figure 1 shows the US CPI and US Core CPI since 1990. Both indicators are at levels last seen around 1990s, which is quite worrying, as during the dot-com bubble and the global financial crisis, the CPIs did not spiked as much as they do now. Even more worrying is the fact that inflation is only expected to drop in summer in 2022, although this threshold has continuously been postponed, as the anticipated peaks have. A large contributor to this development are the interventions of the Federal Reserve, as shown in Figure 2. Not only has the Fed printed substantial amounts of money to fight the economic damage of Covid-19, but it also used quantitative easing to a huge degree. The balance sheet of the Fed grew from $732bn in 2002 to $2.2tn in 2009 and to $8.6tn in 2021. The increase in 2020 exceeds $3.1tn, which is more than the total balance sheet was after the financial crisis in 2007/08. This further emphasizes the degree of the intervention of the Fed. In the UK, the situation does look slightly better. This can be largely attributed to the lesser intervention from the Bank of England (BoE). Although the percentage increase is similar, the assets of the BoE “only” increased by £0.5tn and are currently at £1.07tn, as shown in Figure 3. Currently, inflation in the UK is only at 2% but it is expected to rise during 2022. In August 2021, the estimated peak was at 4%, while in November 2021, this was corrected to 5%. Unfortunately, this has been a general trend in 2021. Hence, it can almost be expected that these estimations will rise going forward.

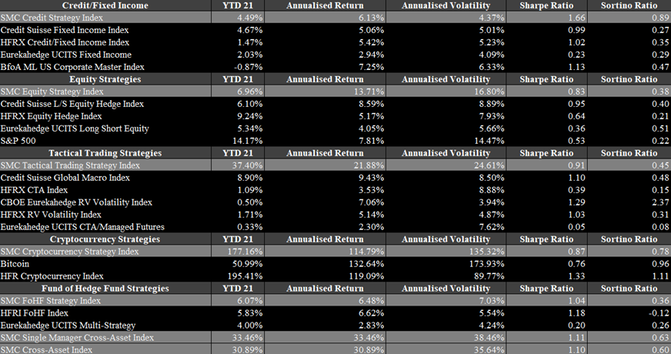

Hedge funds have experienced a great third quarter and continue to do well in October 2021. Partially due to the surge in volatility, the hedge fund industry is close to reach a milestone of $4tn in AuM. Nevertheless, the strategy of hedge funds is of utmost importance when determining how well a hedge fund is doing. This is in particular true for 2021. Crypto and equity hedge funds tend to profit the most from the current market ecosystem, as their asset class is surging at a rapid pace. Global macro and fixed income-based strategies have a more challenging ecosystem. Figures 1 to 6 show the returns as of Q3 2021 of the different SMC Strategy Indices in comparison to other relevant benchmarks for the specific strategy. Cryptocurrency strategies unsurprisingly did the best this year with the average strategy being up 177%. All strategies in that area cover the best performing strategies of the year with Token Liquid and Token being the best among them with a performance of 316% and 260%. The SMC Equity Strategy Index achieved a lower return than some of its benchmarks in 2021 with 7% as of Q3 2021. The best performing equity strategy is Equities US Activist Event Driven which is 27% up in 2021. With regards to the less beneficial ecosystems for fixed income and global macro related strategies, the SMC Strategy Indices did well. The SMC Credit Strategy Index is up 4.49% an outperforms almost all benchmarks shown in Figure 2. The situation is even better for the SMC Global Macro Strategy Index that achieved a YTD of 37.40%, thereby outperforming any benchmark by a lot as shown in Figure 4.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed