|

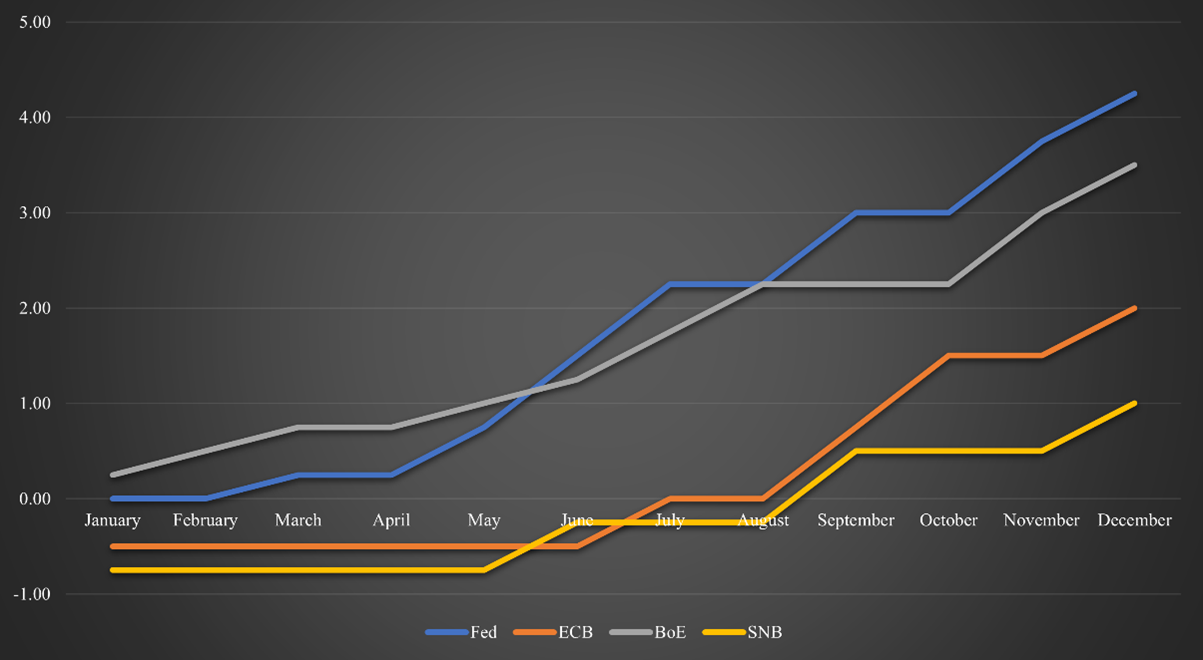

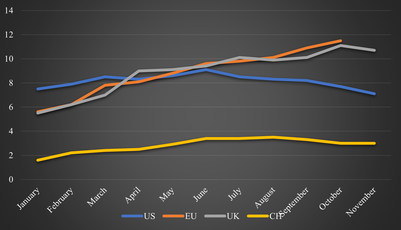

With the final interest rate decisions of most central banks this year, it concludes a year of strong intervention to combat soaring inflation caused by the aftermath of Covid-19, and the ongoing war as well as general political instability. The Fed, the BoE, the ECB, and the SNB all increase their respective target rates by 50 basis points. The US interest rate is now at 4.25% - 4.5% with the British interest rate slightly lower at 3.5%. The European Union’s interest rate ends the year at a 2% target with the Swiss interest rate even lower at 1%. Figure 1 summarizes the interest rate hikes of these central banks during 2022. The UK and the US moved relatively quickly in increasing interest rates compared to the ECB and the Swiss National Bank. The impact of these measures is mixed at best. While inflation has been rampant throughout the year, only the Fed’s measures seem to have calmed inflation to a degree. The US inflation peaked in June at 9.1% and fell to 7.1% as of November 2022. Although they managed to control it, the degree to which inflation is reduced is far lower than the interest rate impact. Despite a similarly strong stance by the BoE, inflation is going up and down with a tendency to go up. The UK inflation remains at 10.7%. Compared to the US, the UK is dealing with several other issues not prominent in the US. Not only is the UK still somewhat in a transition phase with the EU, but it is also more directly impacted by the ongoing war and experienced a few chaotic months with the election, the resignation of ex-PM Truss, and her historical tax cut when the economy was already strongly under pressure. Inflation in the European Union is also unlikely to slow down fast given the close involvement in the war and the slow reaction to the rising inflation. As of October 2022, the EU’s inflation is the highest of the four economies at 11.5%. Lastly, Switzerland reacted slightly faster than the EU but hikes less aggressively. However, compared to the other economies, Switzerland does not face such an imminent problem with inflation, as the current inflation rate is only 3% with its previous peak being in August 2022 at only 3.5%. Figure 2 summarizes the development of inflation across the four discussed economies during 2022. Despite the general tone of central banks that they plan to decrease their balance sheet and keep raising interest rates well into 2023, market participants see fewer interest rate hikes ahead with a potential reversal earlier than expected. Going forward, interest rates will rise further with likely declining inflation, as the measures should work in the longer term. When inflation is showing signs of a continued slowdown and comes back to reasonable levels, interest rates are likely to decline gradually. This transition period will be especially intriguing to fixed income hedge funds and instruments, as high interest rates and low inflation offers stable and low-risk returns. This is especially true, as this economic ecosystem has not been present in the past decade. Equities did well in the latter half of 2022, despite the unfavorable ecosystem with rising interest rates and a harsh economy. If the situation should normalize sooner than expected, equities are well positioned to regain some of their incurred losses in the first half of 2022. Macro strategies have had an exceptional year in 2022 with plenty of opportunities. Most macro hedge funds could use these opportunities to generate strong returns.

Central Bank Interventions of the Fed, ECB, BoE, SNB Inflation in the US, the EU, the UK, and Switzerland

Voices of a recession in the coming year are getting louder. With the currently high inflation across the world, increasing interest rates, and drained reserves from the Covid-19 pandemic, companies are facing a bumpy road ahead. While inflation is declining to some degree, the crisis is far from over. In the US, inflation declined to 7.7%. This is likely a consequence of the continued and steep interest rate hikes from the Fed throughout the year that start paying off. With the most recent inflation data, the Fed hinted at lower hikes in the short term. In Europe, inflation is still higher, with 10% for the European Union and 9.6% for the UK. Nonetheless, it decreased in both instances compared to the previous month. Another interesting development is the price cap by the EU on Russian oil. It should mitigate Russia’s capabilities to finance the war with oil sales. Russia already stated that it will not oblige to the price cap. Over the past six months, oil substantially lost value. While it was trading well above $120 per barrel during the year, over the past six months it dropped. WTI crude oil is currently trading at $73 per barrel and has lost almost $10 per barrel since the official launch of the price cap on Russian oil. Figure 1 shows this development over the past six months. It will be interesting to monitor this development in terms of oil prices in general and whether the cap has the desired impact to stop Russian war financing. Since the end of Q3 2022, equities managed to rebound quite strongly and offset a proportion of the losses of the first three quarters this year. In contrast to the poor Q1-Q3 2022, the private equity industry was relatively stable over this time period, albeit with some losses and less activity. Nonetheless, the industry’s number of deals and deal value is still exceeding pre-pandemic levels, which is remarkable. Figure 2 provides further insights into global buyout deals, which make up most of the capital in the industry. Cryptocurrencies have not recovered from the shocking collapse of FTX. Since the collapse, Bitcoin is steadily moving between the $16k and $18k mark. Ethereum similarly moves between a range of $1.1k and $1.3k. Market participants are divided on their current opinions on the cryptocurrency market. With a looming recession ahead, cryptocurrencies are likely to face further drawdowns as highly risk-on assets. However, most people and institutions likely sold their over-allocation during the drawdown of 2022, and it remains to be seen how much more will be sold. Given the continued drawdown, most current holders are less likely to sell their positions due to being convicted of the underlying advances the technology will bring. Additionally, cryptocurrencies have done well in crises. Institutional investors also view the space with significantly different opinions. For example, Goldman Sachs plans to buy crypto on a large scale, while BlackRock is hesitant and expects many more collapses ahead.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed