|

Rising oil prices have been in the news frequently over the past weeks. Back in July 2023, WTI crude oil was below $70 per barrel and has temporarily claimed above $95 per barrel as of the end of September 2023. Price levels have now reached heights last seen almost a year ago, as shown in Figure 1. The latest surge in price was likely caused by continuously declining reserves, which also reached a low point in more than a year. Previously oil prices have been mostly rising, due to production cuts by OPEC+, which was a response to the decline in oil prices the year before. The latest spike was further strengthened by further voluntary cuts by Saudi Arabia and Russia, which are likely to be maintained until the end of the year. Price estimations on oil prices towards the end of 2023 hover around $95 to slightly above $100 per barrel.

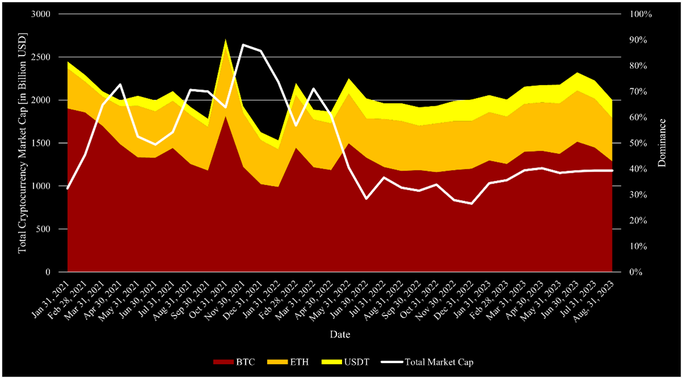

The cryptocurrency markets have been relatively quiet this year. Aside from the surge at the beginning of the year, cryptocurrencies have remained relatively flat since then. The total market capitalization of the industry started slightly below $1tn at the beginning of 2023 and has remained at around $1.2tn since March 2023. The relatively low volatility of the industry also signals a certain level of cautiousness of investors, as the market environment is not great for the industry. In particular recession concerns are holding the industry back, as cryptocurrencies are notorious for sharp declines. Options data on cryptocurrencies also supports a more defensive notion of investors, as implied volatility is close to a record low. The lower degree of risk appetite is also visible in the Bitcoin (BTC) and Ethereum (ETH) dominance. This measure quantifies the total market capital of BTC and ETH respective to the total cryptocurrency market capitalization. Their dominance has been on the rise since Q3 2022 and shows fewer investments in riskier and emerging projects. Similarly, during these times stablecoin gained more importance in the space due to their stability compared to other coins. Figure 1 shows the total market capitalization of cryptocurrencies and the dominance of BTC, ETH, and USDT. Historically, these times are the most important ones for the space, as it drives innovation. With no frenzy, emerging companies are not in a rush to cash out which allows them more time to develop their projects.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed