|

Hedge Funds

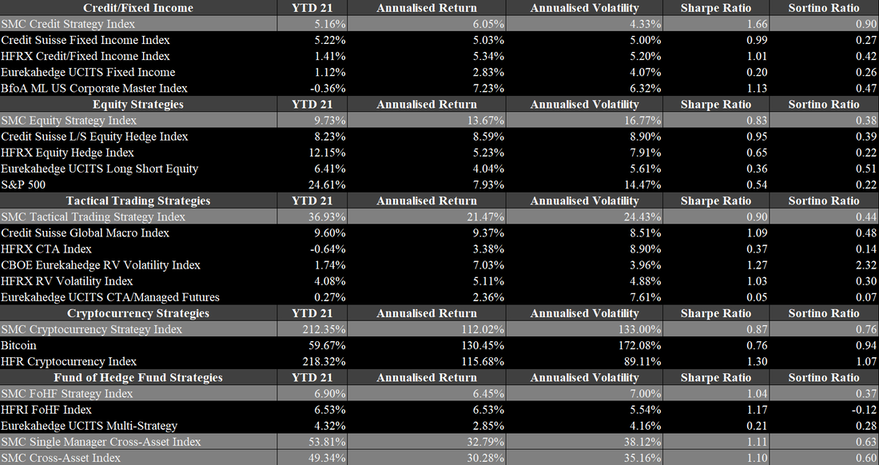

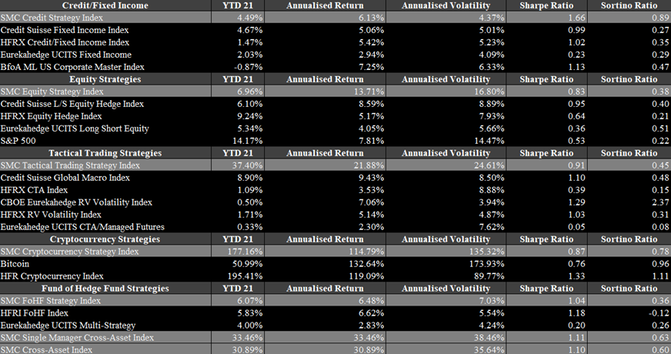

Hedge funds had a great 2021 and managed to set a record high in its AuM. As of the third quarter in 2021, the AuM of the industry is expected to be between $4.3tn and $4.6tn depending on the sources. According to BarclayHedge, the industry’s AuM just surpassed the $4.5tn mark at the end of the third quarter. This is a steep increase from just $3.8tn in 2020, as shown in Figure 6. This is a gain of more than 18% in less than a year. It is expected that the number will rise slightly, once the Q4 2021 numbers are out, as October and November 2021 were rather positive. Nonetheless, December 2021 will have dampened the results of Q4 2021. Generally, the industry has gained substantially over the past ten years, despite a rather inferior view from market participants during most of that period. The AuM soared thanks to two reasons. Firstly, the industry saw substantial capital net inflows. During the first three quarters, the industry received $41bn in fresh capital after having received another $19bn in the second half of 2020. Since then, the industry saw net inflows in every quarter, which is stark break from previous years when the industry experienced net outflows in most quarters. In Q4 2021, net inflows rose to $81bn in 2021, according to Eurekahedge. Figure 7 also shows the severe initial impact of Covid-19 in 2020, when accounting for the significantly positive inflows in the latter half of the year. The second reason for the steep increase in AuM is due to the performance of the hedge fund industry in 2021. Hedge funds in 2021 returned slightly more than 10%, making it the third best year in history after 2020 and 2009 according to HFR. This is remarkable, as the year has not been easy with the constant uncertainty and high volatility in the market. In particular event-driven, equity and commodity strategies have performed very well and the high beta strategies within their respective sector. Figure 8 summarizes the performances of several strategies during 2021 by Eurekahedge. Distressed debt and event-driven strategies performed best with barely any negative performances during the year. Macro and fixed income strategies struggled the most throughout the year, due to the harsh economic conditions. When looking at the highlighted percentiles, it is evident that the high volatility in the market also caused high volatility in hedge fund returns, independent of the strategy. This is most relevant for long short equity strategies whose returns vary between +30% (upper percentile) and -10% (lower percentile) in 2021. Figures 9 to 13 highlight the SMC Strategy Indices in 2021 compared to their benchmarks. The SMC Credit Strategy Index gained slightly more than 5% in 2021, although the variation across strategies is substantial. Two strategies, Trade Finance Crypto and European High Yield L/S Credit did very well in the economic environment, as they reached returns above 12% and 19% in 2021. The Trade Finance Strategy is in particular remarkable, as the strategy has not experienced a negative month since its inception in 2017. The SMC Equity Strategy Index gained closely less than 10%, which is around as much as the average equity strategy in 2021. Within the sector, there was also considerable volatility, due to the sub-strategies. Unsurprisingly, the Equities US Activist Event-Driven performed best with a return exceeding 33%. More tech-focused strategies faced more issues but returned closely below 10% after an extremely successful 2020. Global macro strategies had a tough year and closed only slightly positive for the year. The SMC Global Macro Strategy Index is up almost 37% in 2021, which is largely due to the Discretionary Global Macro Strategy achieving a return of almost 70%. To nobody’s surprise, cryptocurrency strategies performed best in 2021. The SMC Cryptocurrency Strategy Index gained more than 212% in 2021. In the space, it was most important to hold a diversified account of cryptocurrencies to achieve such a great return, as Bitcoin (BTC) gained only 60%. The most successful strategies in the space focused on riskier tokens. The Token and Token Liquid strategies gained 295% and 385% respectively. Despite the great results of 2021, the gains are still inferior to the 342% in 2020. The developments in the crypto space will be discussed in a further paragraph. Lastly, another indicator that the industry is in a healthy state is the fact that the number of launches substantially exceed the liquidations and the number of active funds has reached an all-time high of 22,081.

Alternative Markets Outlook 2022

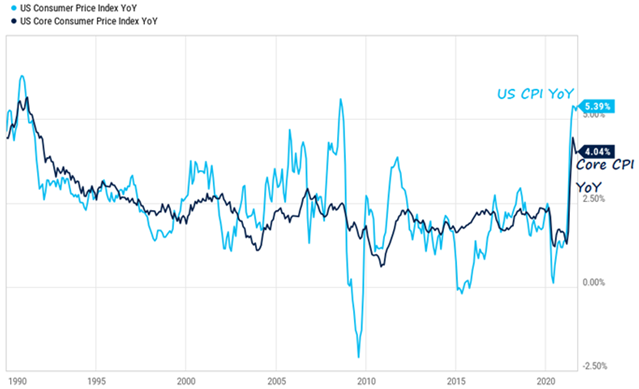

2021 was firmly in the grasp of Covid-19 through the Delta and Omicron strain. Although Covid-19 was managed solidly, the imposed restrictions and the economic interventions have severely impacted the economy and society. Not only has inflation skyrocketed but it is also likely to persist for quite some time. In January 2021, the US CPI was at 1.4% and rose to 6.8% in November 2021. In Europe, the situation looks similar, although the initial surge started earlier in the US and currently Europe’s inflation is lower with 4.9% in November 2021. In 2022, inflation will prevail with even higher levels in early 2022 with a realistic chance to subside towards the latter part of 2022. This rather grim outlook is largely in line with the observation during 2021, when inflation targets were mostly too low and the estimated time period were too short. The US will probably experience slightly higher levels, due to the larger extent of money printing to fight Covid-19 originally. Central bank intervention will be reduced to normal levels in the latter part of 2022. It has been already announced that they will scale back their asset buying programs but not entirely. Depending on how Covid-19 is evolving, it seems reasonable that towards the end of 2022, these programs will be discontinued. Aside from these monetary interventions, there were also substantial fiscal interventions, as shown in Figure 1. Figure 1 depicts the US national debt and the increase of additional trillion of debt. Since Covid-19 emerged, six additional trillions were spent to fight the immediate impact. In particular, the speed at which the money was spent is remarkable. While it took between 30 and 300 days for an additional trillion during Covid-19, it took between 170 and 320 days during the global financial crisis in 2008. The measure undertaken to fight Covid-19 are massive but they have helped the economy to bounce back. Among others, the development of the employment is largely desirable. For example, in the US, the unemployment rate was reduced to 4.2% from its peak of more than 14% in 2020. Equity markets, which have contributed in a major fashion to the overall success of 2021, will be largely impacted by Covid-19 in 2022. This was once again observable in November 2021 when Omicron emerged. Assuming a positive development, it is likely that equity markets will keep rising, although at a normal pace below unlike 2020 and 2021. Figure 2 and 3 show the S&P 500 and the Euronext 100 indices over the past two years. Since January 2020, the S&P 500 gained 47.5%, while the Euronext 100 gained 18.9%. The gains since their bottom in March 2020 are 118.4% for the S&P 500 and 86.0% for the Euronext 100. One potential reason for the strong growth in 2020 and 2021 may be due to expected inflation ahead, which is compensated by higher nominal gains. This effect is likely to fade given the enormous growth numbers in 2021 which have given rise to doubts about the sustainability of these profits alongside fears of another financial bubble. This is in particular true for industries that have benefited from Covid-19, such as technology. One example of seemingly unhealthy gain is Tesla, which is up more than 1,000% since Covid-19 emerged. The companies benefiting from Covid-19 should be viewed with caution, while companies that were negatively affected by Covid-19 certainly involve less risk. A negative development with the handling of Covid-19 could turn the situation upside down again and trigger similar effects as in March 2020. This may occur, for example, if a new strain emerges with a substantially increased fatality rate, is spread relatively easily and vaccinations are of only mediocre effectiveness against the new strain. Yet, this scenario is rather unlikely given that with each wave, the number of infections remains at a relatively similar level, while hospitalizations and fatalities decline. Furthermore, virus strains that spread more easily, such as Omicron, frequently are less deadly. These two observations favour the good scenario going forward. In an environment of high volatility and many opportunities, alternative assets are well positioned. Figure 4 highlights the volatility in the market measured by the VIX. Since the occurrence of Covid-19, the volatility in markets has never reached levels prior to Covid-19, although there has been a massive improvement. From the peak in March 2020 and a level of more than 80, markets have stabilized between 15 and 25 in quiet times with occasional spikes. With regards to alternative assets, 2020 and 2021 were highly beneficial for several reasons. Firstly, in crises, actively managed vehicles are of increased interest as they try to mitigate the negative impact of the crisis. Secondly, due to the nature of being a healthcare crisis, this brings many opportunities with it. Thirdly, the substantial uncertainty in markets also favour alternative assets, as for example, private equity funds are less sensitive to significant short-term volatility. 2021 was especially profitable for the private equity and hedge fund industry, which make up the largest part of alternative assets. In the following sections, hedge funds, private equity, private debt and crypto assets are discussed in a more detailed fashion.

Hedge funds have experienced a great third quarter and continue to do well in October 2021. Partially due to the surge in volatility, the hedge fund industry is close to reach a milestone of $4tn in AuM. Nevertheless, the strategy of hedge funds is of utmost importance when determining how well a hedge fund is doing. This is in particular true for 2021. Crypto and equity hedge funds tend to profit the most from the current market ecosystem, as their asset class is surging at a rapid pace. Global macro and fixed income-based strategies have a more challenging ecosystem. Figures 1 to 6 show the returns as of Q3 2021 of the different SMC Strategy Indices in comparison to other relevant benchmarks for the specific strategy. Cryptocurrency strategies unsurprisingly did the best this year with the average strategy being up 177%. All strategies in that area cover the best performing strategies of the year with Token Liquid and Token being the best among them with a performance of 316% and 260%. The SMC Equity Strategy Index achieved a lower return than some of its benchmarks in 2021 with 7% as of Q3 2021. The best performing equity strategy is Equities US Activist Event Driven which is 27% up in 2021. With regards to the less beneficial ecosystems for fixed income and global macro related strategies, the SMC Strategy Indices did well. The SMC Credit Strategy Index is up 4.49% an outperforms almost all benchmarks shown in Figure 2. The situation is even better for the SMC Global Macro Strategy Index that achieved a YTD of 37.40%, thereby outperforming any benchmark by a lot as shown in Figure 4.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed