|

Although financial markets are struggling in general, cryptocurrencies are suffering most. After the collapse of the Terra stablecoin in mid-May 2022, cryptocurrencies barely recovered their losses. Even before this crash, the market was down substantially. This development may indicate another ‘crypto winter’ as it was the case in late 2017 and early 2018. After this crash, Bitcoin needed until 2020 and other cryptocurrencies until 2021 to recover. Although the current ecosystem is certainly not favourable, the situation is not equivalent to 2017. There are numerous reasons for this. Firstly, the investor base has changed massively with many more institutional investors in the market. This is likely to reduce the volatility of the asset slightly, as the majority of capital in the market is still retail-based. Secondly, the principle of blockchain and the applications are a lot better understood than back in 2017 when most people held coins for the profit only. Nowadays, assets are also held out of conviction which should further limit the downside potential. Thirdly, cryptocurrencies tend to crash the hardest at the beginning of a crisis but also tend to recover ahead of other asset classes. One of the best examples of this occurred at the beginning of Covid-19 when Bitcoin recovered quickly and soon rose to a new record high. Currently, Bitcoin is trading relatively stable at the $30k mark. The development of Bitcoin during 2022 is shown in Figure 1. Ethereum is trading consistently trading below the $2k mark since the crash.

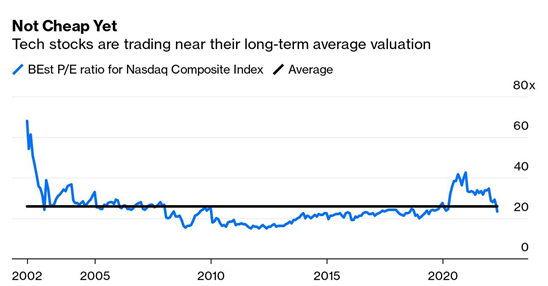

Financial markets are experiencing tremendous daily volatility amid an unprosperous outlook across the board. This is largely caused by the still increasing inflation, steep and continuous interest rates hikes and the ongoing war between the Ukraine and Russia. Outstanding bonds have substantially decreased in prices in 2022 so far and there is little hope that this is going to get better. For example, in the U.S., the Fed just recently started to increase interest rates to an interval between 0.75% and 1%. It is now widely expected that this interval will be increased by 0.5% in each of the following two meetings in June and July 2022. However, it is also being debated if the hikes could even reach 0.75%, if the inflation outlook should worsen. The latest inflation update did not help matters either, as the expected inflation was lower than the actual value. At the moment, U.S. inflation is at 8.3%, just slightly below the March’s numbers of 8.5%. When looking at the inflation level across the world, it is still increasing in most countries. Although inflation is low in China, it increased substantially from 1.5% to 2.1% in April. In the Euro area, inflation has now reached a level of 7.5%. The ECB told earlier in the year that interest rate hikes are unlikely to occur before the latter part of H2 2022. Currently, there are strong signals that ECB will begin raising its interest rates in July. This grim outlook has led to substantial sell-off of treasuries. Meanwhile, the 10-year U.S. Treasury has surpassed the 3% mark in early May. Aside from rising interest rates, central banks are planning to shrink their balance sheet, which will put further pressure on equities and the market in general. Equities have further suffered in May, even after one of the worst months in April 2022. In particular, technology stocks have substantially decreased, as they have been inflated the most since the central bank interventions following Covid-19. The Nasdaq Composite Index is down already 25% since the beginning of 2022. Figure 1 shows a comparison of the current tech valuation compared to their historical average.

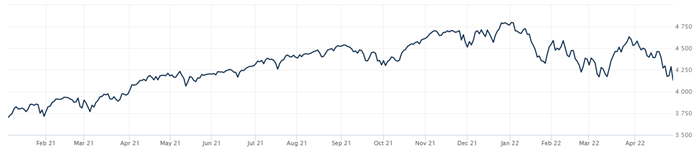

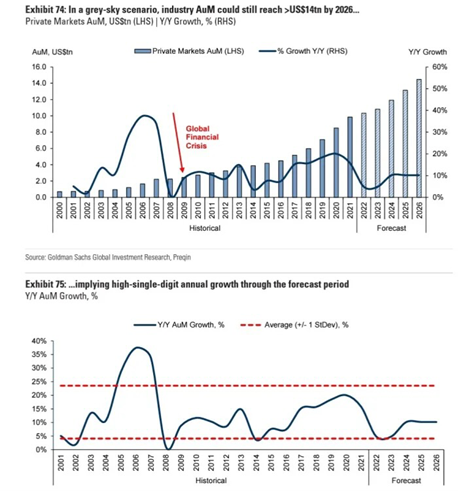

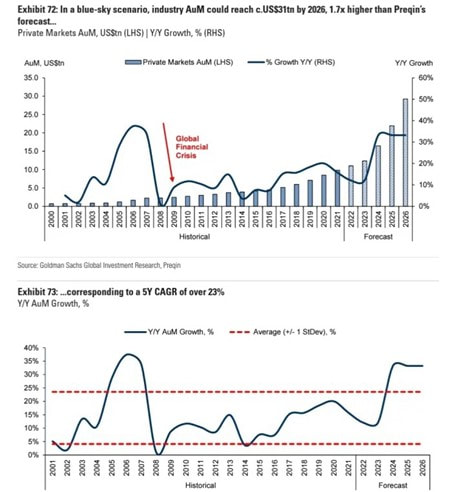

Markets are continuing to struggle in 2022. Equity markets have suffered substantial losses after their stellar 2021 caused by a combination of inflation, (expected) interest rate hikes and the Russia-Ukraine war. After the strong selloff at the end of April 2022 which closed the worst monthly performance since the financial crisis, equity indices are down substantially. The S&P500 is down almost 14% YTD while the tech-driven Nasdaq index is down more than 21%. The development of the S&P500 since January 2021 is shown in Figure 1 below. After its record high from the end of 2021, the index is as low as one year ago. Although equities are still high from a historical perspective, the anticipated, and very likely, interest rate hikes from the Fed are on the horizon. It is anticipated that the Fed will increase rates by 0.5% in May and possibly another 0.5% in June. This has a substantial impact on still highly valued stocks which will put further pressure on equities. Central banks are feeling the consequences of their extensive interventions during Covid-19. It led to record inflation levels (at least of the last 40 years), and the imminent treat of recession if interest rates are increased. Nonetheless, if interest rates are not increased, inflation could spiral out of control, if it has not already. Given that inflation has reached 8.5% in the US and 7.4% in Europe, the necessity to intervene is obvious. These difficult times are another opportunity for hedge funds to prove their worth, as they have since Covid-19. Despite losses of the industry collectively during Q1 2022, the industry still sees continued inflows. The difficulties from the uncertainties at the current moment make hedge fund selection more important, as the gap between good and bad hedge funds widened. Given the current market situation, equity-neutral, global macro and commodity-based strategies achieved great results. In particular our Discretionary Global Macro strategy had a phenomenal month with a gain of more than 50% in March and a gain of almost 150% in Q1 2022. Our crypto- and equity strategies did well in March 2022 and could partially offset their loss from earlier in the year. Nonetheless, this is unlikely to continue in April, due to the selloff in both markets at the end of the month. Another great alternative to be partially shielded to current market volatility is private equity and venture capital. Although both markets benefitted greatly from the overheated public markets in the past two years, valuations have declined slightly. Regardless of the decline in valuations, there is still a huge interest in the space as money keeps flowing in and the deal activity is very high in the space. The large amount of capital in the space alongside the competition are also likely to prevent such large decreases as the public equity markets see currently. Both of these markets, hedge funds and private equity, are large drivers of alternative markets. According to research from Goldman Sachs and Preqin, the AuM will significantly increase, even in a suboptimal ecosystem. In a grey-sky scenario, they expect the industry to grow to $14tn in 2026, up from $10tn in 2021. In a more favourable blue-sky scenario, they expect the AuM to rise to $31tn in the same time frame. Figures 2 and 3 show their findings.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed