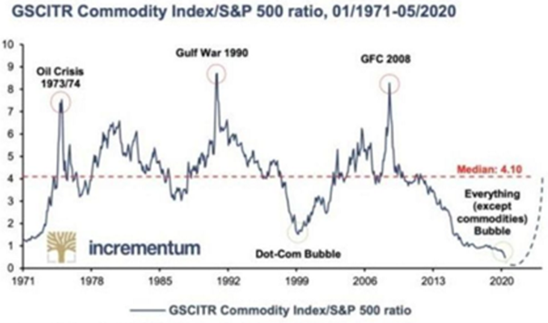

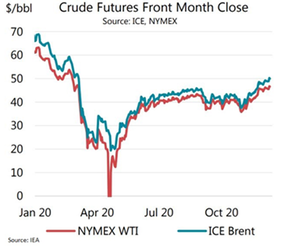

Commodities, aside from gold, mostly had a bad year. Figure 3 shows how commodities have developed in comparison to the US stock market. The essence is that commodities have never been worth so little in comparison to equities and after each crisis, there was a huge turning point. The worst start in 2020 certainly had oil, whose futures (WTI Crude) went negative when the crisis picked of steam in developed economies, which was thought to be impossible. It then recovered fairly quickly and stabilized at $40 for WTI Crude ever since, which was the case for most commodities. Towards the end of November, it started to surge again and continued to do so in December and is currently at $47 per barrel. A major driver for this development is certainly the start of vaccinations and the expectations of going back to normal relatively soon. Brent crude oil experienced a similar rally, although it started to soar earlier and thus gained a bit more than WTI. Brent Crude is now trading at $50 per barrel. Another commodity that has recovered very well is copper. It is trading at 7,068$/mt and has just slightly surpassed its highs from early 2018. During the crisis, it was trading at around 5,000$/mt. Furthermore, the price of copper is unlikely to decrease in the near future, as the stockpiles have not been as low since 2014

Alternative Markets Update December 2020 - Macro and Political Outlook December 2020 by Macro Eagle6/12/2020

Macro and Political Outlook December 2020 by Macro Eagle

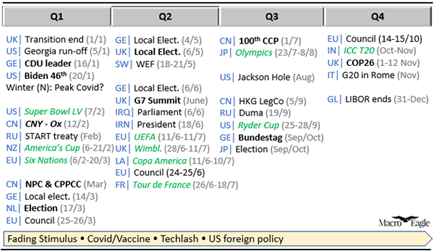

THE YEAR AHEAD After the sharpest global economic downturn since WW2 (-4%), next year the West will hope that the 2020-stimulus plus vaccine-rollout leads to an economic rebound without pushing yields higher (Debt Crisis? What debt crisis?). On the big themes, I think the “K-nature” of the Covid recovery has some serious political risks (more below). I do think the love for all digital will continue, but beware of BigTech valuations and regulatory Tech-lash. Climate change will continue to drive the agenda, but beware of the ESG bubble. And as for geopolitics with Biden – I expect him to be as tough with China as Trump, just more polite. Apart from the US transition (more below) and China’s next 5-Year-Plan (more below) the two countries to watch are: post-Brexit Britain (more below) and Merkel-Daemmerung Germany (more below). |

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed