|

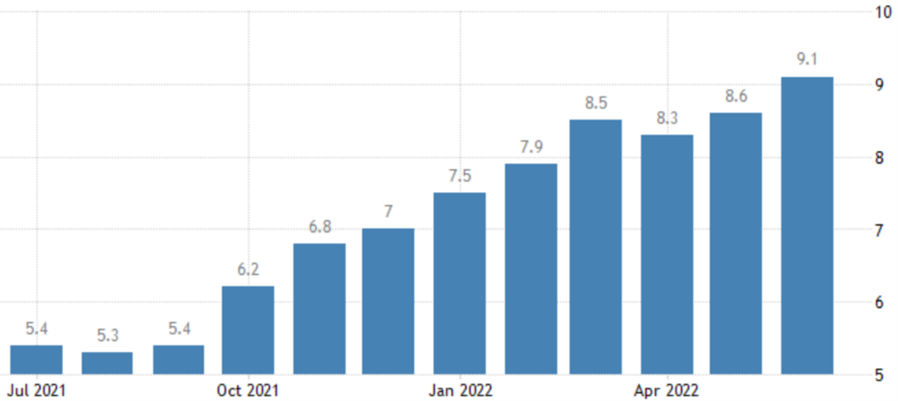

Macroeconomic factors continue to dominate financial markets. Inflation in the US keeps rising, despite attempts of the Fed to slow it down. In June, inflation rose to 9.1%, higher than the anticipated 8.8%. Figure 1 summarizes the development of inflation over the past year in the US. The major drivers remain food and energy, but these are not the only issues. As the prior two are global issues, it is unlikely that those factors will slow down quickly. The Russia-Ukraine war has a substantial impact on those factors. Russia, a key supplier of energy, has led to the possibility of Europe not being able to use as much energy for heating in the winter as usual. Ukraine, which is a key supplier of food, e.g., wheat, puts further pressure on food prices. That Russia started burning down acres does not help the matter either. Although this has no direct impact on the US, the impact on the price of those goods is a significant contributor to the increased prices of those goods. This development has caused markets to anticipate an even larger hike in the upcoming July meeting. Markets analysts now see a hike of an entire percentage point as possible. This further emphasizes how dire the situation looks, as a few months ago, the discussions were between no hikes, a 25 bp, or at worst a 50bp hike. The US federal fund rate is now at 1.75% and likely to rise substantially. Despite these increases, inflation hit a record high (within the past four decades) in June 2022. With this in mind, voices of a looming recession are increasing. The fact that the yield curve inversion between 2y and 10y-Treasuries is at its highest since 2000, does not help mitigate this threat. Figure 2 shows the recent inversion of the two Treasury yields. This recession indicator should not be considered too much, as depending on which maturities are compared, the implications look very different. In Europe, the situation is even more serious. Not only is the continent directly affected by the war and its possibly horrendous outcomes, but it is also susceptible to possible bottlenecks for both energy (in particular gas) and food. Additionally, EU inflation hit a new record of 8.6% in June 2022 without any central bank interventions yet. The development of inflation in the EU is shown in Figure 3.

With the announcement of the CPI rising again in May 2022, the Fed was put under even more pressure as the previous hikes did not show the desired effect. This led to the announcement of the Fed increasing the federal fund rate by 75 basis points instead of 50 which was the prediction ahead of the bad CPI news. In addition, the Fed announced a hike of either 50 or 75 basis points in July to combat inflation. The expectation of the federal fund rate for the end of 2022 is now between 3% and 4% and even higher for the end of 2023. Historically, inflation and interest rates have rarely been so far apart as Figure 1 shows. For example, in the 1980s when the inflation reached 20% for a short time, the federal fund rate was between 10% and 15%. These announcements led to another decline in bond and equity markets. The Fed’s plan to decrease their balance sheet further pressures these markets. In particular, as the decrease just started in June 2022, and is expected to more than double by September 2022. In the European Union, inflation hits a record 8.6% and the central bank is preparing its first interest rate hike. Commodity markets are not doing great either. After their rally in early 2022, largely backed by inflation and war concerns, commodities declined during June 2022, albeit to a relatively low degree. Cryptocurrencies are feeling the pain the most, as Bitcoin dropped below the infamous $20k mark, while Ethereum fell below the $1k mark last week. These was a short-lived recovery which was stopped again by the discussions on regulation of cryptocurrency exchanges in the European Union. Alongside the collapse of TerraUSD (LUNA) last month, the collapse of DeFi platform Celsius and crypto hedge fund Three Arrows did not increase the confidence in the space. Given that the macroeconomic outlook is not favourable, it is unlikely that this decline will revert quickly. It is much more likely to continue for some time. While the decline in crypto asset seems dramatic, it is quite common for the asset class. This is further shown by Figure 2 which compares the drawdowns of asset classes in terms of standard deviations. It shows that the decline in Bitcoin is equivalent to the drop in equities, which are both far less than what bonds experience currently. In particular the 2-year yield has experienced a huge 5.68 standard deviation move. Although Bitcoin is considered the safest crypto investment, a few altcoins managed to outperform BTC during this recent drawdown. Figure 3 shows a comparison of the most important cryptocurrencies and their performance with BTC as a benchmark. In the hedge fund space, conventional bond and equity strategies continue to struggle. More defensive strategies, such as fund of funds, as well as niche strategies that focus on bear markets mitigate the current drawdowns or may even profit from it for the aforementioned niche strategies. The big profiteers of this ecosystem are global macro and commodity funds that have returned huge numbers so far in 2022. The best example for this is the Discretionary Global Macro strategy with a YTD of 158%.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed