Alternative Markets Update December 2020 - Macro and Political Outlook December 2020 by Macro Eagle6/12/2020

Macro and Political Outlook December 2020 by Macro Eagle

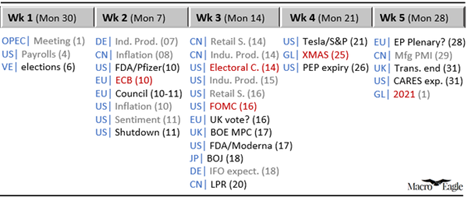

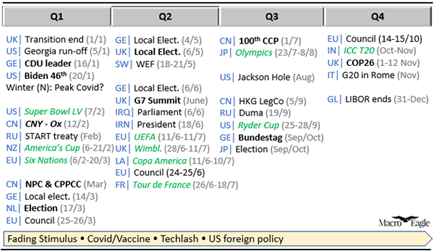

THE YEAR AHEAD After the sharpest global economic downturn since WW2 (-4%), next year the West will hope that the 2020-stimulus plus vaccine-rollout leads to an economic rebound without pushing yields higher (Debt Crisis? What debt crisis?). On the big themes, I think the “K-nature” of the Covid recovery has some serious political risks (more below). I do think the love for all digital will continue, but beware of BigTech valuations and regulatory Tech-lash. Climate change will continue to drive the agenda, but beware of the ESG bubble. And as for geopolitics with Biden – I expect him to be as tough with China as Trump, just more polite. Apart from the US transition (more below) and China’s next 5-Year-Plan (more below) the two countries to watch are: post-Brexit Britain (more below) and Merkel-Daemmerung Germany (more below).

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed