|

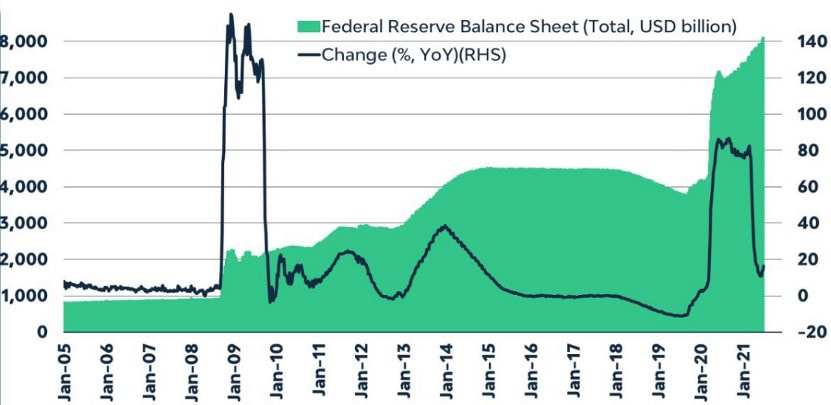

Inflation has been among the most important concerns in 2021, after the world has been able to fight the virus to some degree after over a year and a variety of vaccines. The inflation concerns stem from two main sources, the increased liquidity provided from central bank interventions through quantitative easing and the stimulus packages from governments. These two major components are shown in Figures 1 and 2. The first figure shows the balance sheet of the federal reserve. Since Covid-19, the balance sheet has doubled to $8tn. Despite the increase being smaller on a relative basis compared to the global financial crisis, the absolute terms differ vastly. While during the global financial crisis in 2008, the balance sheet grew from $1tn to $2tn, which was seen as unprecedented and extremely large intervention, it is only a quarter of the interventions following the occurrence of Covid-19 in early 2020. This has several implications. It will substantially increase the liquidity provided to the financial market and if the balance sheet is reduced, it will likely cause more volatility, as it was the case at the end of 2018 when equity markets decreased substantially. This is under the assumption that Covid-19 is now and will remain at a stage it can be handled. The entire underlying assumption could change, if, for example, a new strain of Covid-19 would emerge that is resistant to the currently available vaccinations. Figure 2 shows the government stimulus packages provided to fight the economic impact of Covid-19, which has surpassed $10tn globally. Again, this provides additional liquidity to financial markets and there has not been a large wave of defaults, due to government guarantees and similar programs. It remains to be seen, how this evolves, once the government guarantees are withdrawn, which could trigger additional volatility in the market. These two indicators suggest that inflation is very likely to increase in the short-term with potentially long-term consequences. Furthermore, instead of only anticipating rising inflation, it started to effectively to show, as the US inflation rate in May has risen to 5% compared to only 1.4% in January 2021 and BoE’s Haldane has warns that inflation is expected to rise close to 4% in 2021. Figure 3 looks at inflation in recent years for selected US consumer goods and services, which have developed vastly different, even when disregarding the impact of Covid-19. For example, within the last twenty years, hospital services have doubled, whereas TVs have decreased by 90%. The overall inflation over this time frame was almost 55%. It seems to be the case that most industries that are substantially affected by the government have increased massively, whereas fewer regulatory inventions have led to decreasing prices of goods and services. However, this is not entirely objective, as three out of the four massively more affordable goods are tech related. For technological products and services, it is common that they are very expensive in the beginning but lose value very quickly and become cheap and widely accessible. In an environment, in which inflation is a huge concern, equities seem like a good way to hedge some of the inflation risk. But, its attractivity is limited, as stock markets have risen incredibly since the initial drawdown caused by Covid-19. The S&P 500, for example, is almost breaking its high on a daily basis with a high of 4,302 (as of 1st July 2021). This boom in the stock market, alongside the surge in valuations of mostly technology companies, has led to 5.2m new millionaires in 2020, as shown in Figure 4. Consequentially, equity hedge funds have done mostly very well last year, some (for example Long/Short US Equity Consumer, TMT, Healthcare) being up more than 60% in 2020. In 2021, the growth has slowed down, as our SMC Equity Strategy Index is up almost 6% as of May 2021. The best performing equity strategy is Equities US Activist Event Driven with a YTD of 26% in 2021.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed