|

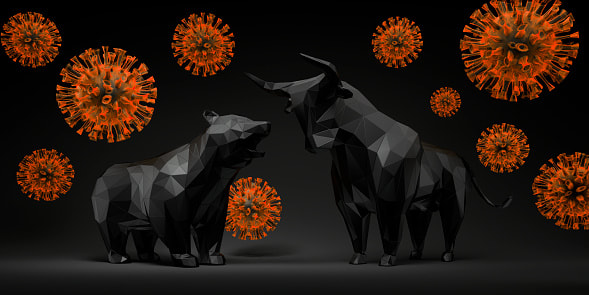

After an exciting time in early November 2021, the enthusiasm in markets faded quickly. The newly found strain of Covid-19, called Omicron, caused a minor shock to markets. Apparently, it seems to be milder than for example the delta variant, but it spreads even faster. Nevertheless, any conclusions on the virus strain are too early to be reliable. Omicron further worries European countries, as their number of cases has been surging regardless of the high vaccination rates. Many countries are imposing further restrictions, after some travel bans have been initiated. Those have not proven to be effective, as Omicron has been detected in most countries already. Among the strictest countries is Austria that has announced that the vaccination is mandatory as of early next year. Despite this rather grim outlook before Christmas, equity markets only took a slight hit. Figure 1 shows the value of the S&P 500 over the past three months. Even though Covid-19 is again a major topic, the drop was only minimal. Equity markets still had a stellar year. The S&P 500, for example, is up 23.4% as of the time of writing. The SMC Equity Strategy Index is up 10.7% in 2021 and gained remarkable 4.16% in October 2021. Major contributors were the strategies Long/Short US Equity Consumer, TMT, Healthcare and Long/Short US Equities Disruptive Technologies with 9.33% and 9.50% in October 2021. The situation looks a lot worse for oil. WTI crude oil lost almost all gains from the past three months, as shown in Figure 2. Oil prices fell from almost $85 per barrel to $66 per barrel. This strong decline stems from the fear of excess supply, if Omicron should lead to more severe restrictions, such as lockdowns. Regardless, oil still has come a long way from its negative value back in March 2020 when Covid-19 became problematic. At the current price of $66 per barrel, oil is up 33.5%, which is still remarkably lower than its previous peak of 67.0%.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed