|

Alternative Markets Outlook H2 2022

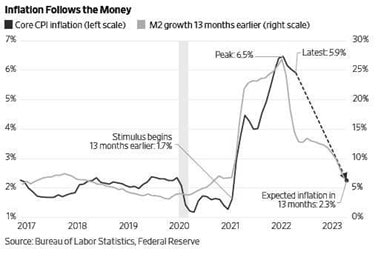

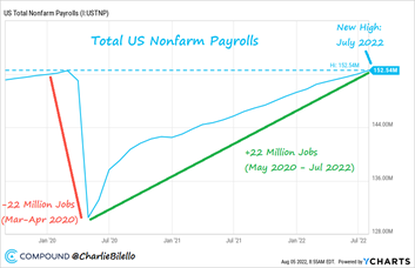

Inflation will likely dominate the news in the latter half of 2022. It is likely to stay high although decreasing. Exact predictions are always difficult, especially in such a market environment. This is also observable in the research from economists who struggle to predict accurately, as employment is high, GDP is shrinking, and the current inflation issues. Whether inflation will in fact slow down is largely dependent on the ongoing war between Russia and the Ukraine, as energy and food are the main drivers behind the current inflation levels. Regardless of how the war ends, even if soon, there is a low chance that the energy supply of Russia to Europe will ramp up significantly. There may be some help from the OPEC+ countries in alleviating the problem but high energy prices are obviously beneficial for them. Food inflation on the other hand is likely to go down to some degree, as the Ukraine is a key supplier assuming that it remains independent. The energy situation will get very tense during the winter, as Europe is expecting energy shortages. It is likely that energy inflation will spike there. Afterward, in early and mid-2023, the situation likely will improve. At that point, energy prices have a chance to enter a deflationary state, as inflation is measured on a year-on-year basis, in particular when considering that energy inflation is higher than 40% in the US for example. The remaining subcategories in inflation measures are more affected by actual central bank measures. In particular, the US and the UK have taken substantial measures to combat current inflation. At least in the US, the measures have relieved some of the pressure as the monthly inflation fell for the time in a couple of months. However, this does not ease the pressure, as such events must be persistent. It is likely that this will continue, especially if the Fed keeps rising its interest rates, which some of the board members intend to do. It is expected that inflation will keep going down during 2022 and 2023. Frequently expected intervals estimate inflation to be between 2% and 4% towards the end of this period. Figure 1 shows expectations for the core CPI in the year 2023 alongside a lagged M2 growth measure. In Europe, the situation in terms of food and energy is more dire, due to its direct reliance on Russia. However, energy inflation surprisingly is lower than in the US but is rapidly growing, especially with the current concerns about the winter ahead. In terms of central bank measures, it becomes a bit more tricky, as the ECB has to manage many countries and consider their economic situation. This is where its major problem occurs, as large countries, such as Italy, are in a dangerous position. Its debt level is extremely high and it is potentially at risk of defaulting if interest rates should rise. On the other hand, the ECB has to combat the ever-soaring inflation by rising the interest rates. This dilemma will likely reduce the ECB's capabilities to combat inflation by rising interest rates as the UK or the US did. Most likely, this will cause inflation to be mitigated slower and to a lower degree. It is therefore expected that inflation in Europe will still rise in the latter half of 2022 and decline slower than in the US or the UK. This assumption is based on a status quo-like ongoing war. Nonetheless, sudden events can massively alter this outcome. Contrary to the outlook of Europe, the US’s development in July 2022 is largely positive. Firstly, it managed to reduce inflation slightly for the first time in multiple months. Secondly, US employment is back at pre-Covid levels and at the highest since 1969. While the economy lost 22 million jobs in the first two months of the Covid outbreak, in July 2022, it regained all of them. The impressive recovery is shown in Figure 2.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed