|

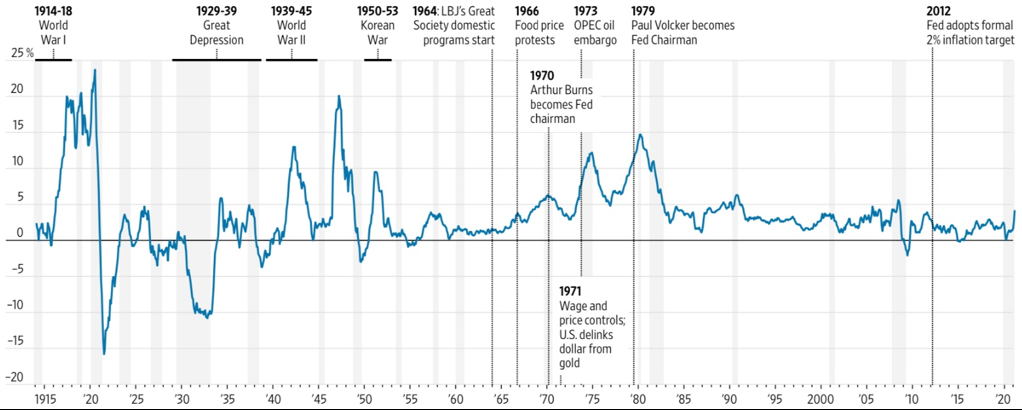

Inflation is one of the most important topics in 2021. The rise in inflation is all but surprising given the central bank interventions of last year. Inflation is as high as it has not been for the past ten years. However, current inflation levels are not of huge concerns, but rather what levels could be reached given unprecedented money printing since Covid-19. Consequentially, many large investors have made moves towards gold and Bitcoin (BTC). Equity markets have also rising tremendously, perhaps already incorporating potentially high inflation in the coming year(s). Figure 1 shows the inflation rate in the US since 1915. In the last 30 years, inflation was rarely higher than it is currently, but the potential of ballooning is substantial. For example, inflation is only slightly lower than it was at the peak of the financial crisis in 2008, but the interventions this time were multiple times higher than back in 2008. Alongside, the more outstanding money, debt of government has also skyrocketed, as governments had to fight the devastating economic impact Covid-19 brought. Figure 2 shows the debt to GDP ratio of most countries. Most developed economies, except the Scandinavian countries and Switzerland, have surpassed a ratio of 50%. Another substantial number of countries have even surpassed the 100% mark, e.g. the UK, the US, and France. The highest ratio is from Japan with 257%.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed