Macro and Political Outlook October 2020 by Macro Eagle

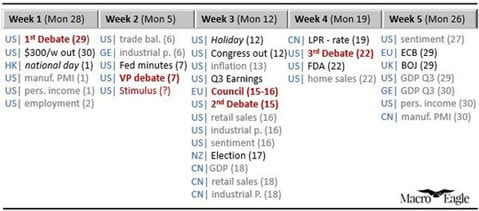

October PREVIEW Packed calendar ahead. This week we get employment in the US, while China goes on holiday for week (mid-autumn festival). Next week we have the only VP debate, plus we will find out if Congress manages to pass another relief-package before the recess starts on Columbus Day (Oct 12th). Then, the Third Week promises fireworks with the EU Council meeting battling over the recovery fund, the EU budget and Brexit. We also get the 2nd Presidential debate, the start of Q3 Earnings and tons of economic data. After that, the Fourth Week brings us the 3rd Debate. Interestingly, on the same day, the FDA will hold a “vaccine update committee”, which makes me think that this could provide a platform for Trump to announce a tactical “huuuuge breakthrough – biggest ever”. Finally, the Fifth Week will feature the ECB (strategy review, PEPP, maybe AIT) while everybody else is counting the days to Election Day the week after. With the al-fresco days of summer now officially over, the start of the “normal” Northern flu season is upon us, so before we talk about the US election, let us quickly turn to Covid.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed