September PREVIEW by Macro Eagle

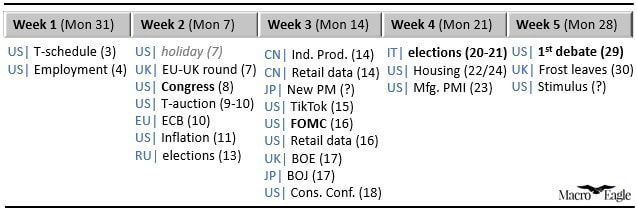

Famously, September is the cruellest month for equity markets, with the Dow down 41/70 times since 1950. Apart from the ongoing issues mentioned above the key events in the month ahead are: Treasury issuance and unemployment figures this week. ECB and Russian regional elections next week. New Japanese PM, TikTok deadline and FOMC during the 3rd week. Italian election during the fourth week. And the first US presidential debate in the last week. All while capital markets get hit by an avalanche of IPOs (Airbnb, Ant Financial, DoorDash, etc.). And don’t forget NATURE. In August we got fires and blackouts in California, hurricanes hitting the Gulf (Laura and Marco), the last ice shelf in Canada’s Artic breaking up and China/North Korea being hit by floods. But it is September when the hurricane season normally peaks.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed