|

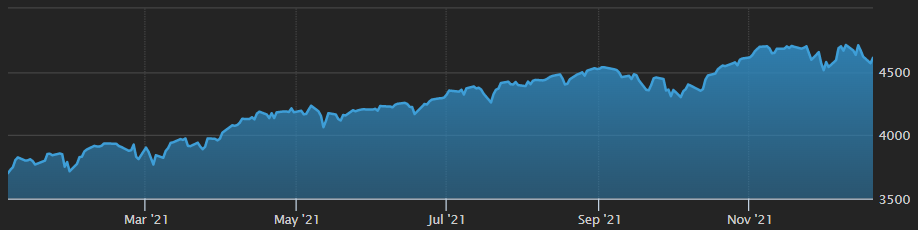

Just before the holiday season, Omicron is spreading rapidly around the world and causes most countries to impose further restrictions. The Netherlands went furthest with a new lockdown over the Christmas holidays. Due to the high infection rate of Omicron, many countries are recommending booster vaccinations for their citizens and introducing requirements of being vaccinated and negatively tested in an attempt to slow down the spread of the virus. This is not the only issue at the moment, as inflation rates are surging around the world. It is also estimated that inflation will remain high for longer than just a few months. In the US, the CPI has reached 6.8% in November 2021, up from 5.3% in August 2021. In Europe, the CPI is 4.9% in November, up from only 3% in August 2021. The situation is similar in the UK with 4.6% in November 2021. Equity markets have strongly profited from the strong interventions of central banks, as shown in Figure 1. After October 2021, equity markets did not maintain their strong upward trend. When Omicron emerged, equity markets dipped. Nonetheless, after it was thought initially that Omicron can be handled to some degree, markets recovered. This recovery only persisted for a short time, as the further restrictions around the world quickly made the illusion of Omicron being handled perish quickly. This strong performance of the public equity market has fuelled the private market. In particular, technology, healthcare and fintech were of tremendous interest. Figure 2 shows a summary of the growth of fintech in 2021. M&A and SPACs achieved a transaction volume of $337bn and several notable IPOs or direct listings have taken place. This includes Coinbase, Robinhood and Nubank among others. Figure 3 shows the development of fundraising in private markets since 2008. In 2021, almost $1tn in capital was raised by private equity, private debt, real estate and infrastructure. This year’s fundraising is the second largest only after 2019. By far the largest contributor is private equity with more than $600bn raised in 2021. Figure 4 shows the increase in AuM of private markets. In 2021, private markets have surpassed the $10tn threshold. In 2021, a substantial increase in allocated capital took place, as dealmaking was difficult in 2020. The fundraising in 2021 also caused the dry powder to remain high despite large commitments. Most of the assets are managed by the private equity industry and other types of assets.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed