|

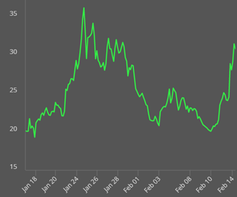

Central banks, inflation concerns, and geopolitical tensions dominate the market in 2022 so far. Inflation keeps rising in 2022. In the US, the CPI already hit 7.5%, the highest it has been since 1982. Energy remains the key driver of inflation at the moment. In Europe, inflation slightly increased from December 2021 to 5.1% in January 2022. In the UK, the increase in inflation is steeper than in Europe with +0.4% last month to 5.4% in January 2022. Unsurprisingly, energy is also the driving force in the UK. Central banks try to keep inflation under control, which they need to do by raising interest rates, which may have a substantially negative impact on the economy. Hawkish central banks are also responsible for the substantial volatility in the equity market. In particular more speculative sectors, such as technology suffered substantially. The two major contributor for the losses in equity markets were the meeting of the Fed at the end of January 2022, in which rate hikes in March 2022 were hinted, and the Russia-Ukraine crisis. Equities recovered slightly since the Fed-meeting, although markets are again bearish. This is largely caused by the substantial likelihood of the Russian invasion in the Ukraine, as meetings between Russia and the US among others have not yielded any results. The tension of these two major events had a substantial impact on the stability of financial markets, as the VIX index highlights in Figure 1. Both events trigger quite strong reactions in a very short time. The situation is far from over, as it is rumoured that a Russian invasion is imminent. Safe haven assets like gold are slowly increasing in value. Gold is trading at $1,850 per ounce, which is slightly higher than it has been on average since its all-time high back in 2020. Oil prices keep surging as well. US oil prices even reached $90 per barrel and are headed for the $100 mark due to the geopolitical uncertainties. Oppositely, Bitcoin (BTC) which is frequently called an alternative to gold cannot compete. Since it peaked in November 2021, it decreased substantially alongside the entire cryptocurrency market. As many currencies have lost more than 50% from their peak in Q4 2021, people oftentimes speak of another ‘crypto winter’, which refers to what happened in 2017/18, when the entire market completely collapsed.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed