ALTERNATIVE MARKETS UPDATE - MID JANUARY 2023 & MACRO AND POLITICAL OUTLOOK 2023 BY MACRO EAGLE11/1/2023

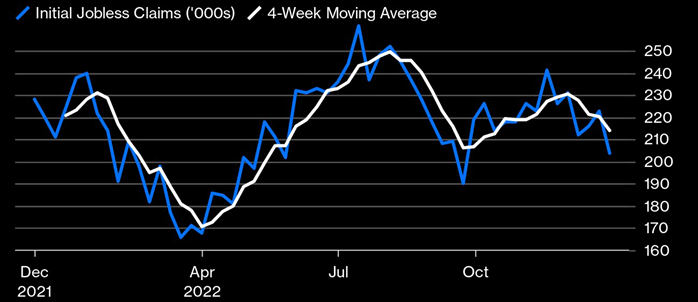

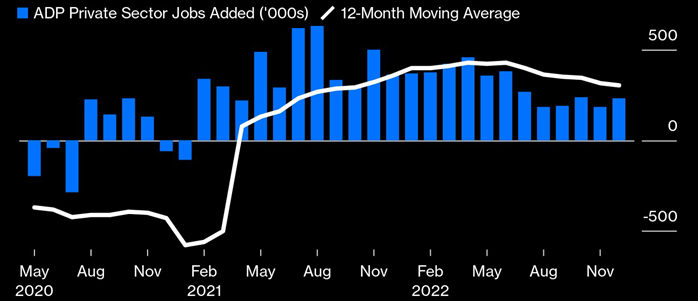

With the currently pessimistic view of 2023, markets are under substantial pressure. Most market participants are expecting a recession in 2023/2024. High inflation, steep interest rate hikes, and historical yield curve inversions are just a few indicators that suggest tough times ahead. However, there are some indicators that provide hope that a larger crisis can be avoided. While inflation is high, it has been steadily decreasing, at least in the US. Rate hikes are also expected to increase only slightly in 2023. Nonetheless, this provides little help in avoiding a recession, as it is still unclear how fast inflation will drop down to the acceptable 2% and below range. Furthermore, interest rates will remain high for 2023 with a low to moderate probability of rate cuts in 2023. These still pressure businesses that are expected to earn less in 2023, as consumers have exhausted most of their resources in dealing with the impact of inflation. The biggest saving grace currently is the labor market, which functions very well. In Western countries, the unemployment rates are close to record lows of the past few decades. In the US and the UK, the unemployment rate is 3.7%. In the EU, the unemployment rate is 6%, while Switzerland sees an unemployment rate of 2.2%. Figure 1 shows the jobless claims in the US in 2022. While there has been some variation during 2022, these were small and at very low levels historically. It is even more promising when addressing the private sector. Since early 2021, the private sector in the US is adding jobs at a constant pace. Figure 2 shows this development.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed