|

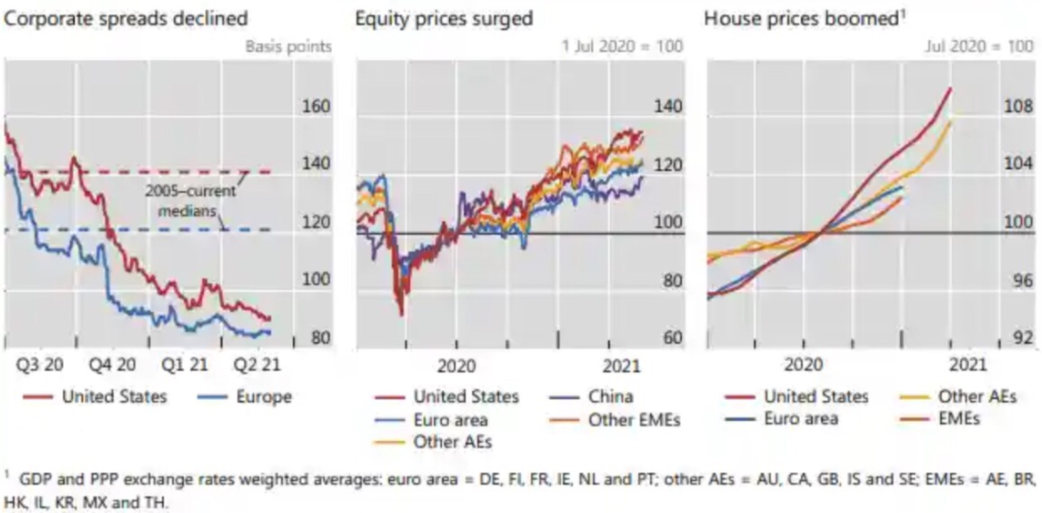

In the current market environment, alternative assets are well positioned. Due to the rise in inflation recently, the falling interest rates and equities being at record highs, it is difficult to allocate capital without huge risks. In this environment, alternative assets provide an attractive opportunity to reduce risk and increase the upside potential. During the last quarter, hedge funds and private equity have reached their record AuM. The interest in hedge funds is likely to increase further, as the industry is doing very well. Not only were drawdowns limited in March 2020, but the recovery was exceptionally strong. Furthermore, the gains in 2021 so far are the best in the last two decades and the number of launches outnumbered the numbers of closures in Q2 2021. Private equity has developed similarly over the last year. Although the beginning was difficult, the subsequent performance was great. However, operating in private equity needs a bit more caution, as a record amount of dry powder was assembled in the last year and the competition in the market fierce, which in turn, leads to higher prices and valuations. In particular in the VC space, voices of a bubble are getting louder. Housing prices have shown a very strong recovery from an initial slump after the pandemic hit, which is a consequence from the extraordinary financial conditions, largely caused by fiscal stimulus by governments and the loose monetary policy by central banks. Credit spreads have fallen to an almost record low level, despite declining profits from companies, at least initially. This suggests that market participants are aggressively seeking risk in the current financial market. Figure 1 shows a comparison of corporate spreads, equity prices and housing prices. On a relative scale, housing prices have risen more than equities since the initial Covid-19 outbreak. KKR for example has raised a $2.2bn fund for real estate deals in Europe, but real estate investments are surging as well in developing countries, such as in the UAE, in which luxury house sales are rising. There is also an increased interest in real estate tech which surged recently, certainly also boosted by the generally great performance of tech stocks.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed