|

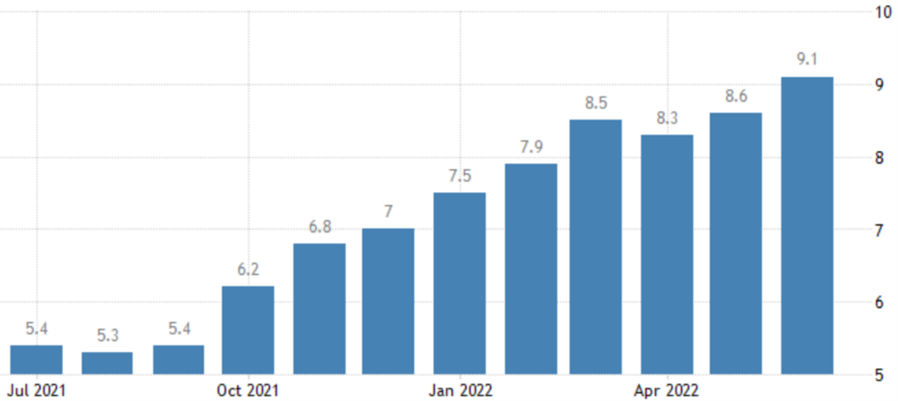

Macroeconomic factors continue to dominate financial markets. Inflation in the US keeps rising, despite attempts of the Fed to slow it down. In June, inflation rose to 9.1%, higher than the anticipated 8.8%. Figure 1 summarizes the development of inflation over the past year in the US. The major drivers remain food and energy, but these are not the only issues. As the prior two are global issues, it is unlikely that those factors will slow down quickly. The Russia-Ukraine war has a substantial impact on those factors. Russia, a key supplier of energy, has led to the possibility of Europe not being able to use as much energy for heating in the winter as usual. Ukraine, which is a key supplier of food, e.g., wheat, puts further pressure on food prices. That Russia started burning down acres does not help the matter either. Although this has no direct impact on the US, the impact on the price of those goods is a significant contributor to the increased prices of those goods. This development has caused markets to anticipate an even larger hike in the upcoming July meeting. Markets analysts now see a hike of an entire percentage point as possible. This further emphasizes how dire the situation looks, as a few months ago, the discussions were between no hikes, a 25 bp, or at worst a 50bp hike. The US federal fund rate is now at 1.75% and likely to rise substantially. Despite these increases, inflation hit a record high (within the past four decades) in June 2022. With this in mind, voices of a looming recession are increasing. The fact that the yield curve inversion between 2y and 10y-Treasuries is at its highest since 2000, does not help mitigate this threat. Figure 2 shows the recent inversion of the two Treasury yields. This recession indicator should not be considered too much, as depending on which maturities are compared, the implications look very different. In Europe, the situation is even more serious. Not only is the continent directly affected by the war and its possibly horrendous outcomes, but it is also susceptible to possible bottlenecks for both energy (in particular gas) and food. Additionally, EU inflation hit a new record of 8.6% in June 2022 without any central bank interventions yet. The development of inflation in the EU is shown in Figure 3.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed