|

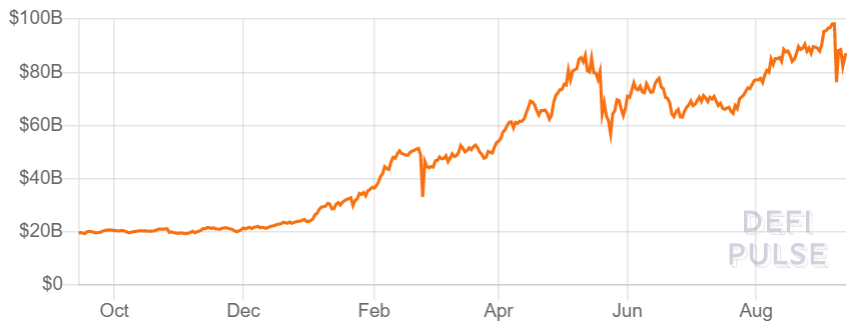

In such a highly uncertain environment, cryptocurrencies tend to thrive. Since the middle of July 2021, cryptocurrencies have performed very well. In particular applications on layer one chains, such as Bitcoin (BTC) and Ethereum (ETH), surged during this time. These applications can be split into several categories. These include for example, decentralized exchanges (DeX) and decentralized finance (DeFi). DeX’s are on the rise and are continuously optimized. At the current time, Uniswap v3 is the DeX with the largest trading volume ($800m in 24h), followed by PancakeSwap v2 with around $378m in 24h. In total, 10 different DeX’s have a daily trading volume exceeding $100m. These numbers are quite impressive given that centralized exchanges are young themselves. Binance, by far the largest cryptocurrency exchange, has a daily volume of $23bn. Coinbase, probably the most famous one due to going public, only has a daily volume of around $3bn. DeX’s have two major advantages compared to centralized exchanges. They tend to be cheaper, as only the gas for the transaction needs to be paid and they typically have no downtime, which occur quite frequently for centralized exchange in highly stressed environments. Yet, DeX’s remain a relatively small proportion of cryptocurrency exchanges. Over the last months, FTX was the most talked about exchange for several reasons. FTX is a cryptocurrency derivatives exchange and made headlines with its last funding round. FTX raised $900m and is now valued at $18bn. This is especially remarkable, as the company was valued at $1.2bn a year ago. Furthermore, there is barely any day without announcement about their attempt to increase their brand awareness. Tom Brady, Gisele Bundchen and Stephen Curry are just some brand ambassadors. They have also secured the naming right for stadiums, e.g. the Berkeley stadium, and have entered a multi-year sponsorship deal with the famous e-sport team TSM. Despite the significant spending on their brand awareness, the public seems to react well to their efforts, as their token (FTT) has reached a new record high, as shown in Figure 9. Another significant player among cryptocurrency exchanges is Bakkt, the first exchange that offered physically settled BTC futures and options and being owned by the Intercontinental Exchange (ICE). Although, it is known that Bakkt will go public since January 2021, it is widely anticipated that this should take place relatively soon. It is certainly interesting to find out where the second cryptocurrency company will end up after its SPAC listing valued at $2.1bn. The other category mentioned previously, DeFi, is more well-known since its application are very diverse. DeFi is typically measured by the total value locked (TVL) in DeFi, which is shown in Figure 10. Shortly before the most recent crash, TVL reached almost $100bn. At the time of writing, TVL is around $87bn. This is remarkable as at the beginning of 2020, TVL was only several million. Yet, the metric is not entirely transparent and various sources claim hugely different values. The issue with the metric is the tracking of the capital committed, measured by the collateral to make decentralized applications (DApps) comparable, as some of them are levered. But the measurement of TVL is difficult for several reasons. Firstly, the measure counts all values of different chains and the respective sub-chains. As they launch frequently, there can be mismatches. Secondly, various DApps allow all kinds of collaterals and those can be traded centralized, on-chain or off-chain, which makes their aggregation difficult to track. Lastly, value locked may be misleading, since liquidity can be added and removed very quickly, which poses additional tracking difficulties. DApps in DeFi also have the potential to revolutionize the traditional banking system, as basically any function from traditional banking is already available as DApp. Many early DApps focused on payment solutions, as many see the current payment methods

from the banking system as flawed in particular cross-border transactions, the time they require, and the fees associated with transactions. There are also many non-blockchain based solutions out there already with online banks, such as Revolut, or Wise that recently went public. Newer DApps started focusing on the lending function of the current banks. At the current stage, most capital in DeFi flows into such lending applications. The most valuable ones are Aave, Maker and InstaDApp, which all have around $13bn value locked in the application. InstaDApp is an asset management platform for DeFi platforms. It makes transactions between DeFi platforms easy, and it does not trigger fees, except the gas costs for the movement of assets. InstaDApp has now fully issued their token (INST). The price development of INST is shown in Figure 11.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed