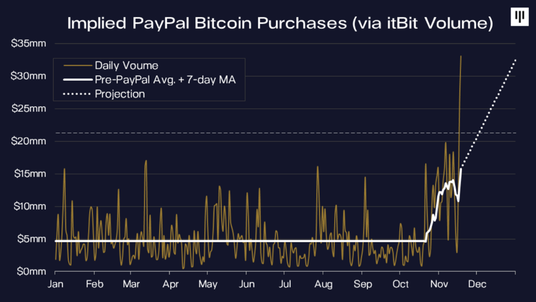

The rapidly increasing value of BTC is largely associated with the recent announcement of PayPal to accept BTC as currency, giving access to BTC to more than 300 million users, compared to only 100 million prior BTC users. According to Pantera Capital, this has had a major impact on BTC. Figure 4 below shows the increase in BTC purchases from itBit, the provider that PayPal uses for crypto transactions. Currently, Paypal and other providers are buying more than 100% of all newly issued bitcoins, creating additional demand with it. As highlighted in the figure below, the volume of transaction is shown, which remained stable during the year, but increased tremendously since PayPal enabled BTC transactions. Given the huge surge during the last two weeks, the demand is likely to increase even more, indicating that the current surge is not over yet. Moreover, if BTC surpasses its record high from 2017, it will cover the news even more, another indicator for an even higher price.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed