|

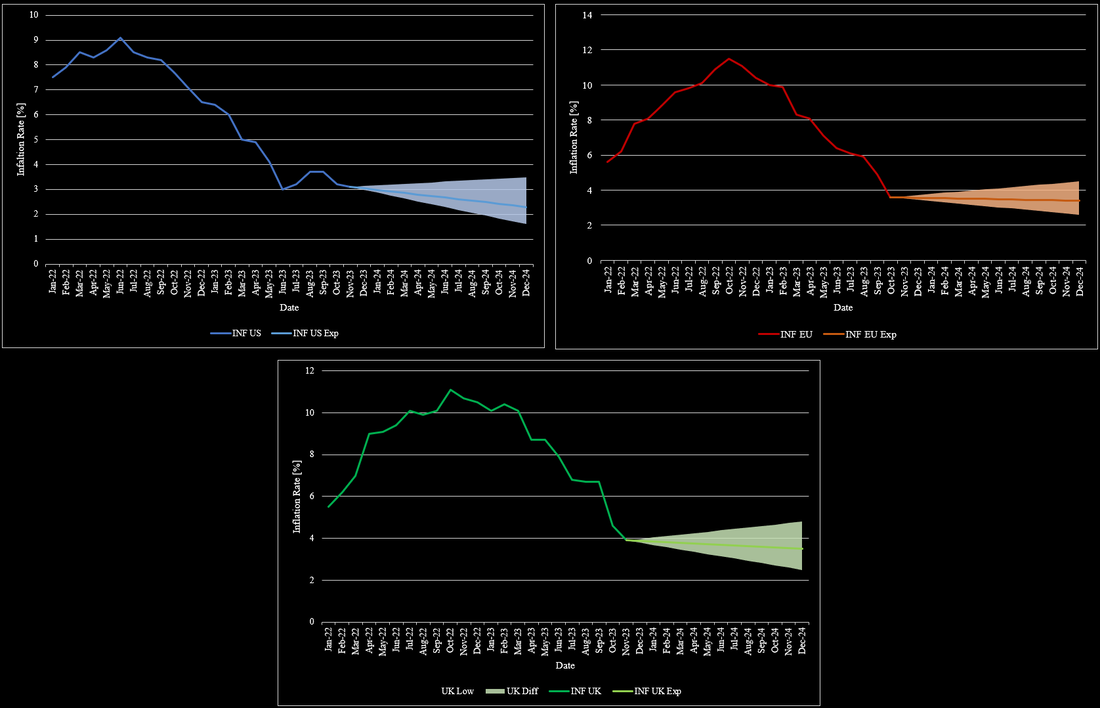

Inflation and interest rates have been present topics. Inflation rates have continuously decreased throughout 2023 across most economies. While this development was promising, it was necessary as inflation rates went as high as almost 12% towards the end of 2022. In the US, inflation has decreased to 3%-4% in the past few months with no particular direction since then. For 2024, it is widely expected that inflation will decrease further, albeit to a limited degree. Most market participants expect inflation to be around 2.3% by the end of 2024. Others see inflation to drop to as low as 1.6%. Assuming no further geopolitical crises and no further escalation of existing crises, inflation is unlikely to rise further than 3.5% by the end of 2024. Figure 1 shows the development of inflation rates in the US, UK, and the EU from January 2022 to the end of 2024. The general sentiment that inflation rates should fall is intuitive given the high interest rates at this time. In the EU, the development has mostly mimicked the US, but with a delay of a couple of months, due to a more restrictive central bank policy when Covid-19 emerged. Inflation in the EU has also reached a point, where inflation is no longer declining at levels slightly below 4% after being at 10% at the beginning of the year. For 2024, inflation is also expected to further fall, but not to the same degree as in the US. Expectations for inflation in the EU range from 2.6% to 4.5% with the most likely level around 3.4%. The situation in the UK also drastically improved towards the end of the year. UK’s inflation fell to 4% after lingering around the 10% mark for almost an entire year. Inflation expectations for the UK are mostly equivalent to the EU’s expectations, but its projections are more volatile based on the country’s state over the past few years.

*|MC_PREVIEW_TEXT|*

Comments are closed.

|

|

|

Stone Mountain Capital LTD is authorised and regulated with FRN: 929802 by the Financial Conduct Authority (‘FCA’) in the United Kingdom. The website content is neither an offer to sell nor a solicitation of an offer to buy an interest in any investment or advisory service by Stone Mountain Capital LTD and should be read with the DISCLAIMER. © 2024 Stone Mountain Capital LTD. All rights reserved. |

RSS Feed

RSS Feed